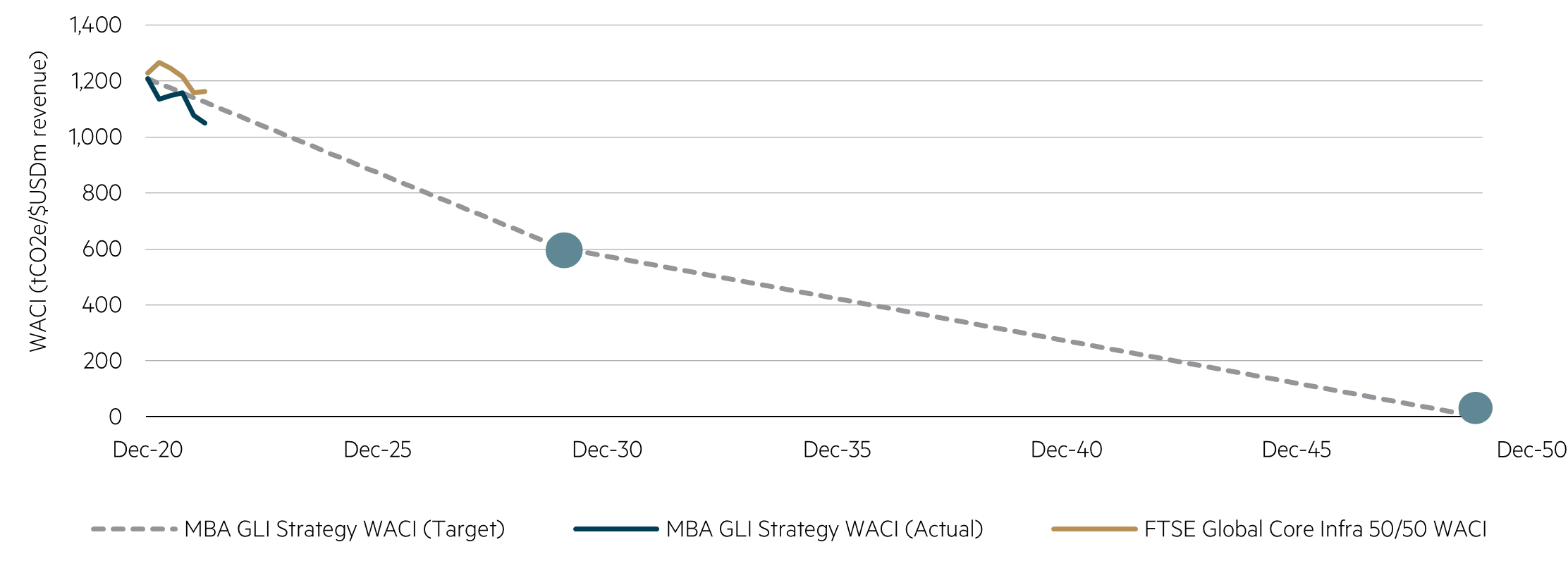

The Maple-Brown Abbott Global Listed Infrastructure (GLI) team has solidified its commitment to prepare for the escalating risks of climate change and capture emerging opportunities from decarbonisation by setting an interim target of a 50% reduction in emissions intensity by 2030 for the strategy.(1)

In October 2021, we joined the Net Zero Asset Managers Initiative, affirming our commitment to align the GLI strategy with a pathway towards net zero emissions by 2050. By setting our own net zero commitment and interim emissions target, we are formalising our existing approach to managing climate risks and opportunities, using best practice tools, engaging with companies on decarbonisation and improving environmental outcomes. We believe this will help deliver better long-term investment outcomes for our clients.

Listed infrastructure companies are at the forefront of the energy transition

As long-dated assets that provide essential services to society, listed infrastructure companies play an integral role in supporting and facilitating the energy transition. Electricity grid infrastructure, renewable energy, battery storage and electric vehicle charging infrastructure are examples of infrastructure assets critical to the global drive to reach net zero. They are among the assets the GLI strategy actively targets.

The net zero ‘norm’

Our targets represent a significant step-down in emissions. Given the pace of the energy transition and its ongoing acceleration, we believe such a target is achievable for the strategy and the sector as a whole.

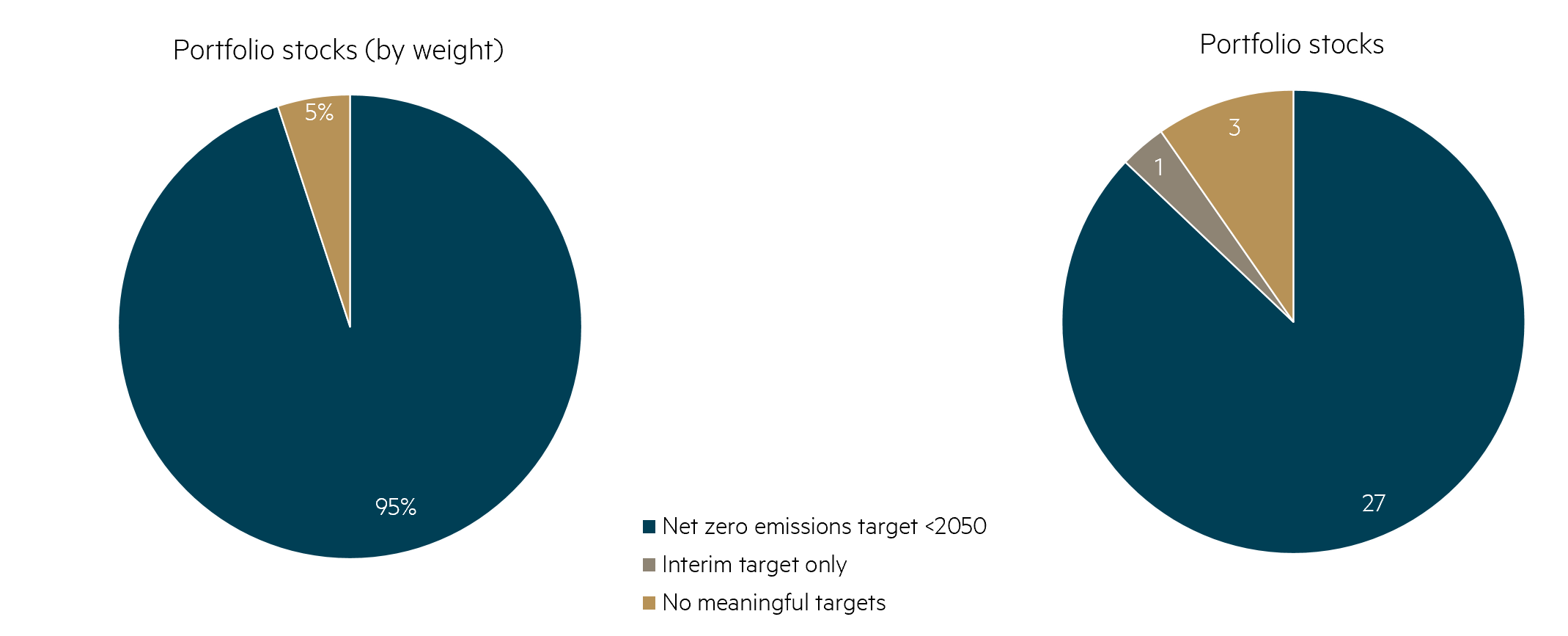

About 95% of GLI strategy holdings have a net zero target in place, while most of the remaining have set short-term targets.(2) It is clear the energy transition is well underway, and listed infrastructure companies are at the forefront.

What does ‘net zero’ mean?

A ‘net zero’ target is where an entity – such as a company or investment manager – makes a time-specific commitment to reducing their direct or indirect emissions to an absolute minimum. Any remaining emissions that cannot be mitigated are potentially offset through methods such as afforestation or carbon capture.

The ultimate aim of a ‘net zero’ target is to contribute towards keeping global warming to well below 2ºC by 2050 in line with the goals of the Paris Agreement.

Weighted average carbon intensity (WACI) USD

A directional pathway for the GLI strategy

Source: Proprietary analysis using investee companies’ emissions reduction progress and emissions targets reported to the GLI team in response to a GHG Emissions Questionnaire, which was issued to companies in October 2021. This chart is not a forecast. A representative Maple-Brown Abbott Global Listed Infrastructure fund has been used as a proxy. As at 31 March 2022.

Net zero emissions targets in the GLI strategy (3)

Transparency is important

The GLI strategy’s emissions targets:

- relate to all greenhouse gas (GHG) emissions and not just carbon dioxide

- cover scope 1 and scope 2 GHG emissions

- use a weighted average carbon intensity (WACI) calculation in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

- apply to all GLI strategy companies.

Modelling our targets

We undertook a thorough evaluation of strategy companies’ emission targets, progress achieved to date and the likelihood of achievement. We then projected each company’s emissions out to 2030 based on the assumption that companies with interim emission targets achieve those targets and companies without interim targets retain current levels through to 2030.

Using these estimates in conjunction with GLI proprietary company revenue forecasts, we arrived at the portfolio’s expected emissions intensity in 2030, which implies a 50% reduction by 2030. We plan to regularly review our targets to reflect the pace of companies’ decarbonisation efforts.

A roadmap to achieve our targets

We expect companies to provide a clear plan on how they intend to deliver on their emissions targets, and we apply these same standards to ourselves. From a stock selection perspective, we are targeting low carbon and transitioning companies that are set to capitalise on – and benefit from – the energy transition thematic.

Also, due to the potential for stranded asset risk, we will not invest in companies directing capital expenditure towards greenfield coal-fired power generation. From a stewardship perspective, we are actively engaging with companies we consider are lagging behind and/or at risk of greenwashing while casting proxy votes to support these objectives.

1 Using a weighted average carbon intensity (WACI) methodology. Relative to a December 2020 baseline.

2 A representative Maple-Brown Abbott Global Listed Infrastructure fund has been used as a proxy. As at 31 March 2021. The percentage has been calculated using position weights. Net zero targets relate to either direct emissions, or a combination of direct and indirect emissions.

3 A representative Maple-Brown Abbott Global Listed Infrastructure fund has been used as a proxy. Analysis based on desktop and broker research as at 31 March 2022. The type and ambitiousness of net zero targets varies across companies and industries. “No meaningful targets” refers to companies that do not have medium and long-term targets aligned with the goals of the Paris Agreement. Companies with no meaningful targets and those with low quality net zero targets are the subject of focused engagement activity.

Disclaimer

This material was prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is registered as an investment advisor with the United State Securities and Exchange Commission under the Investment Advisers Act of 1940. This material does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This material contains general information only and it does not have regard to any investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This material does not constitute an offer or solicitation by anyone in any jurisdiction. This material is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views of the authors as at the date of publication and are subject to change without notice. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this material does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. This information is current as at the date of publication and is subject to change at any time without notice.