Investors face important decisions with markets at record highs. Most asset classes are trading at historically high prices and many major stock markets are at, or around, all-time highs. The MSCI World Index traded at its highest during the September quarter as did the S&P/ASX 300 Index (Total Return). On the back of significant price gains, the forecast price earnings multiple (PE) for industrials in the Australian market is now an extraordinary 29 times, 70% above the 20-year average.

As investors know only too well, much of the current ‘rosy’ investment environment is not due to a particularly favourable economic outlook (anything but in many ways), but to exceptionally loose monetary conditions supported by strong fiscal stimulus.

In our view, the sustainability or otherwise of markets at these levels is thus critically dependent on the pace at which interest rates normalise – the risk free rate being a crucial building block in the investment equation.

This helps explain why investors hang on every word of central bankers. It also highlights the significant risks inherent in undertaking valuations today because at the heart of the valuation process is an interest rate which is probably more ‘nuanced’ than at any time in recent history.

Investors are in many ways ‘dancing in the dark’ as markets are not providing the signals they should. This is highlighted in the historically low negative real interest rates seen in developed markets.

Real yields set to rebound from historic lows

* Nominal yield deflated by three year tralling OECD CPI. † BoA Global Sovereign Bond Index Yield to maturity. US recessions (shaded) Source: Minack Advisors

Real interest rates are at levels not seen for decades – a combination of a surge in inflation and the impact of quantitative easing on nominal interest rates. Real rates should rebound as some of the temporary supply factors impacting inflation reverse (the question though is how much lower inflation actually settles), and as nominal interest rates begin to normalise. However, many investors don’t see this as today’s problem, and this largely explains the apparent asset bubbles we see across many asset classes, as well as the extreme divergence in valuations seen in stock markets. Low interest rates have provided great support to those parts of the market with long-dated earnings (even more so for those parts of the market with little or no earnings, for example, many Tech names).

Impact of price signals seen in various markets

With rates so low, investors in this part of the market are very happy to forgo income from their investments in hope of a substantial future payoff. It is not only in the growth equities space that price signals are having an impact. The residential property market is another obvious example of what happens when key economic variables are ‘stage managed’. Property prices in Australia (and across much of the developed world) have seen record gains and activity levels have picked up materially. Reserve Bank Governor Phil Lowe has noted that while monetary policy has played a role in surging house prices, structural issues such as taxation policy, supply of land and planning are the primary cause of the problem (and hence house prices are not a key consideration for the Reserve Bank). While this may be the case longer term, there is little doubt that the economy faces significant risk that home buyers are misguidedly acting on these interest rate signals when assessing longer term affordability considerations. A material correction in property prices has the potential to significantly derail the recovery from COVID lockdowns and potentially create financial stability issues. Following its recent consultation in Australia, the International Monetary Fund recommended that macroprudential policies be strengthened in the face of increasing financial stability risks. Residential property is thus another market where price signals are potentially giving investors the wrong message, with the risk of an untoward outcome.

It is interesting to contrast the valuation impact of price signals being communicated by exceptionally low interest rates to price signals in energy and commodity markets. In a recent interview with Bloomberg News, Chevron CEO Mike Wirth notes that the world is facing high energy prices for the foreseeable future as oil and natural gas producers resist the urge to drill again. “There are things that are interfering with market signals right now that we haven’t seen before,” he said.(1) Wirth goes on to note that although soaring commodities markets are “signaling we could invest more”, equity prices are sending boardrooms a different sign. “There are two signals I’m looking for and I’m only seeing one of them” right now, he said. “We could afford to invest more. The equity market is not sending a signal that says they think we ought to be doing that.”

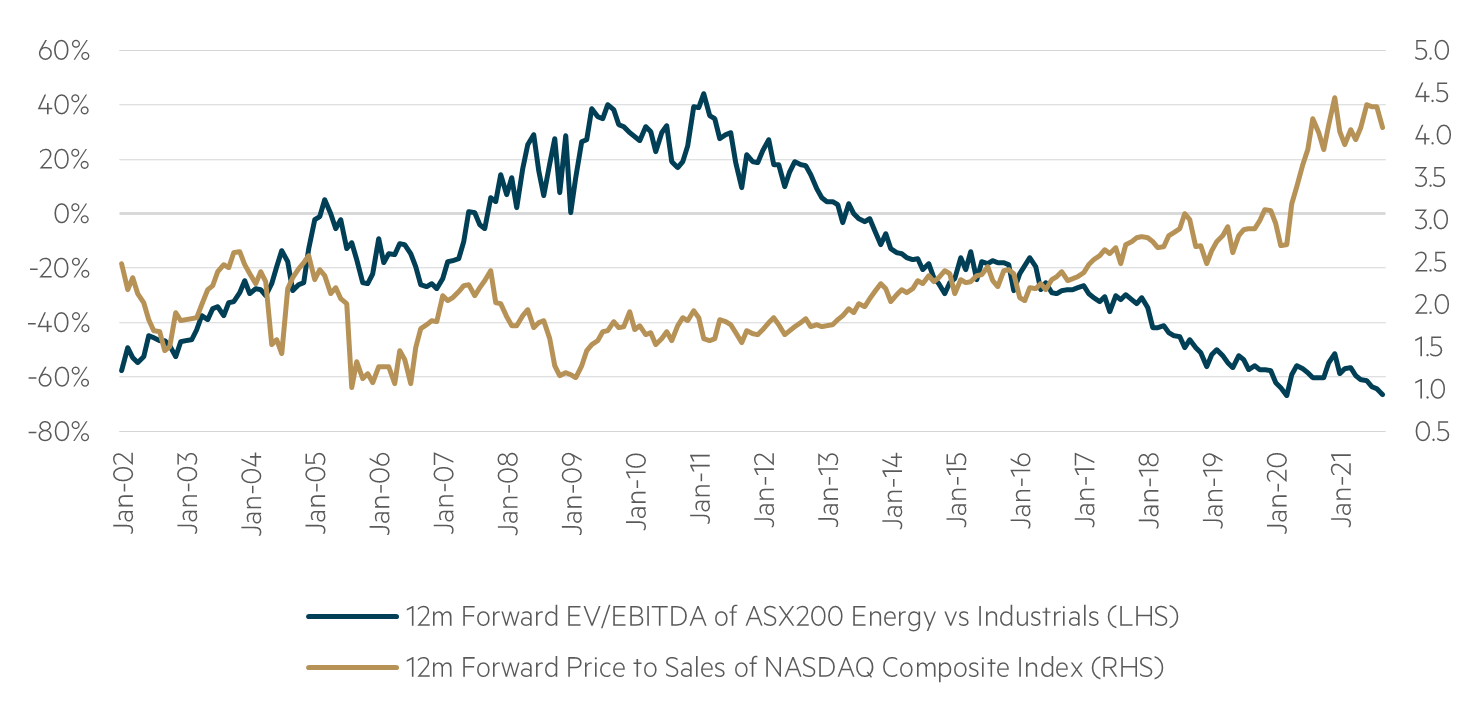

As already noted, in some markets (such as Tech) extraordinarily low interest rates have devalued cash in the hand today with investors happy to trade this off for the long-dated hope of speculative wealth. In the commodities and energy markets the situation is completely different; a combination of ESG considerations and far too much money wasted in previous cycles is seeing investors demanding cash today. We may well see a replay of the early 2000s when investment in Tech waned after the Tech Bubble burst and stock prices plunged, while commodity markets boomed as demand (spurred on by China in that instance) overwhelmed supply. As contrarian investors, we are attracted to the opportunities offered in the commodities space (particularly energy) as pricing signals are largely ignored and the market continues its focus on beneficiaries of low interest rates.

When ‘cash’ doesn’t always matter

Energy caution sees sector de-rating but Tech speculation grows

Source: Goldman Sachs, Bloomberg, data to 30 September 2021

Significant opportunity for value investors to build on gains

Returns have been strong, but the question remains as to whether market strength has been built on a foundation of sand. Central banks across the world (including Australia) continue to be extremely active participants in secondary bond markets, often purchasing a significant portion of the bonds issued to finance extensive deficits. This has kept interest rates at unusually low levels, particularly in the face of rising inflation and expansive fiscal policies. Industrial stocks have never sustained PE multiples anywhere close to 30 times (noting that many leading names are trading well north of that) and the current environment is hardly conducive for that to change. Just as industrial stocks have benefited greatly from (unrealistically) low interest rates, much of the rest of the market has been left behind. Strong price signals in the commodities space have largely been discounted or ignored while financial stocks have perversely labored under the interest rate signals that central banks wish investors to hold to. The past 12 months have seen the beginning of a recovery in the performance of value managers, but this has largely been a catch-up from the post-COVID bear market rout of many of the already out-of-favour sectors. Valuation differentials between many stocks and sectors remain extreme, and this provides significant opportunity for value investors to build on the gains of the past year

(1) Chevron CEO Warns of High Energy Prices and Supply Crunches by Kevin Crowley, Bloomberg, 16 September 2021

Disclaimer

This material was prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is also registered as an investment advisor with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. This information is intended solely for professional and institutional investors and is provided for information purposes only. This material is not intended for, and is not suitable for, retail clients and does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This material does not constitute an offer or solicitation by anyone in any jurisdiction.

This material is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this material does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. This information is current as at 30 September 2021 and is subject to change at any time without notice.