The Maple-Brown Abbott Global Listed Infrastructure (GLI) team has long held that data center companies do not exhibit the requisite “core” characteristics of infrastructure, namely due to lower barriers to entry, higher competition and typically shorter contract lengths relative to other “core” sectors.

We re-visited our long-standing position by analysing the key features of data center companies and comparing these to cell tower companies. Our analysis re-affirms our view that data center assets are a subpar avenue for targeting inflation-like protection, higher barriers to entry and lower cash flow volatility in the investment process. We conclude that data center companies do not satisfy the “core” infrastructure definition employed by the GLI team, and rather, appear more consistent with real estate assets or “core-plus” infrastructure. Perhaps it is telling that several data center companies are among the top constituents of various REIT indices but do not feature in major infrastructure indices.1

A summary of our analysis

Our analysis weighs up the level of alignment of data center companies with “core” infrastructure attributes alongside an analysis of cell tower companies as a point of comparison.

Comparison of Key Characteristics

| Data Centers | Towers | |

| Essential service | Yes – essential for data storage, processing and computing to support a wide range of digital processes and functions | Yes – essential component of wireless mobile communications networks |

| Barriers to entry | Moderate – includes capital, land and power, but not intrinsically monopolistic nor operating within a regulatory construct | Moderate/high – natural monopoly over an area due to zoning and electromagnetic spectrum limits |

| Competition | Moderate/high – compete heavily on price, as well as location, product offerings and reliability | Low – due to the above |

| Substitution | Moderate – customers can in-source or self-build, or use the cloud instead of a third-party data center provider | Low – companies have strong protection via long term contracts with specified terms (eg holistic take-or-pay structures, all-or-nothing renewals) |

| Stranded asset risk | Moderate – assets have shorter lives and are exposed to fast-changing technology trends and requirements, including for power and cooling systems | Low – very long physical asset lives |

| Customer base | 100’s of customers; wide range in size and industry; higher credit risk from exposure to SMEs | Few key customers (mobile network operators/carriers); higher concentration risk |

| Contract terms | More volatility – shorter contract lengths (1–3 years for colocation, 5–10+ for wholesale), varied levels of inflation protection | Low volatility – long contract lengths (5–20+ years) with annual escalators (CPI or fixed) |

| Pricing | Market based – determined by prevailing supply and demand dynamics of the market | Set at initiation based on required return |

| Churn | Moderate – varies from 3–10% pa | Low – generally 1–2% pa |

Other avenues to access the data center and digitalisation themes

We believe there are other, more attractive “core” avenues to invest in the digitalisation theme to better deliver on the GLI strategy’s targeted attributes of inflation-like protection and lower cash flow volatility. These include cell tower companies to support wireless connectivity and electric utilities who are attractively positioned to meet growing power demand from the data centers themselves. Industry

In recent years, we have seen a material divergence in the performance and valuations of listed data center and tower companies, with data center stocks performing better over the last two years benefiting from the AI thematic.

Total Return (3 years to 30-Sep-24), indexed to 100

Source: Bloomberg, at 30-Sep-24. Global equities refers to the MSCI World Index; Global listed infrastructure refers to the FTSE Global Core Infrastructure 50/50 Index Net Tax Hedged to USD; DM Data centers is the simple average of EQIX, DLR and NXT; DM Towercos is the simple average of AMT, CCI, SBA, CLNX and INW (all stock returns in local currency).

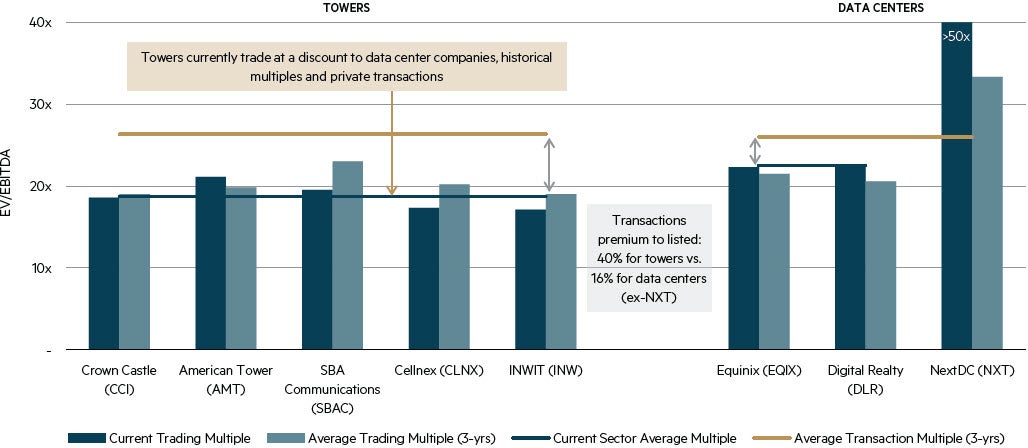

Despite the underperformance of tower companies, recent transaction multiples have been robust and tended to be at a premium to listed company valuations. Notably, listed tower companies trade at a larger discount to historical multiples and comparable transactions than data center companies. We believe this gives rise to an attractive opportunity to access these high-quality digital tower infrastructure assets at favourable valuations in the listed markets.

Valuations of Tower and Data Center Companies

Notes: MBA GLI estimates and Bloomberg data, at 30-Sep-24. EV/EBITDA is rolling 12 months forward, adjusted for non recurring and non cash items and for EU towercos is pre-IFRS 16 (i.e. EBITDAaL (after lease expense) and Enterprise Value excluding lease liabilities, comparable with US GAAP). Data centers sector average excludes NXT. Transactions include whole company and asset sales in comparable markets in our transactions database.

We conclude that data center companies do not satisfy the “core” infrastructure definition employed by the GLI team and are a subpar avenue for targeting inflation-like protection and lower cash flow volatility in the investment process. We prefer to invest in cell tower companies, which we view as having more robust business models, stronger combinations of inflation protection and low cash flow volatility, and more attractive valuations.

1 At September 2024. For instance, in the FTSE Infrastructure 50/50, Dow Jones Brookfield Infrastructure, S&P Global Infrastructure and FT Wilshire GLIO Listed Infrastructure.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL No. 237296 (“MBA”). This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. Past performance is not a reliable indicator of future performance. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Any companies, securities and or/case studies referenced or discussed are used only for illustrative purposes. The information provided is not a recommendation for any particular security or strategy, and is not an indication of the trading intent of MBA. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. This information is current at 9 October 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.