ElecLink: the growing importance of critical infrastructure connecting France and the UK

By Steven Kempler and Gitendra Pradhananga

Transportation infrastructure can play an important role in supporting the energy transition and securing energy supply, alongside renewable energy, storage and transmission and distribution infrastructure. An example is Getlink, the Paris-listed operator of the concession for the 50km Channel Tunnel, connecting France and the UK, and specifically ElecLink, an electricity interconnector cable that passes through the tunnel.

The Channel Tunnel is the only tunnel connecting the UK with continental Europe and serves a number of markets, including high-speed Eurostar passenger trains, the Eurotunnel Shuttle for cars, buses and trucks and international freight trains. Getlink, which has the concession to operate the tunnel until 2086, has been a long-held top 10 position in the Maple-Brown Abbott Global Listed Infrastructure (GLI) strategy.

Getlink shares have performed well over the short and long term*, driven by several factors including growth in Eurostar connections, environmental tailwinds shifting more freight from ferry to rail, the prospect of corporate activity and, most recently, the commencement of operations for ElecLink –a good example of ‘optionality’ embedded in infrastructure assets, where an existing piece of infrastructure can be expanded to provide better, or even new, services.

As the need to simultaneously decarbonise and secure energy supply within the UK and European Union grows, Getlink has been able to contribute to, and benefit from, these thematics. This includes connecting new markets via rail (such as the recent direct Eurostar connection of London and Amsterdam) as well as the ability for other assets, such as ElecLink, to utilise and connect with the tunnel infrastructure itself.

What is ElecLink?

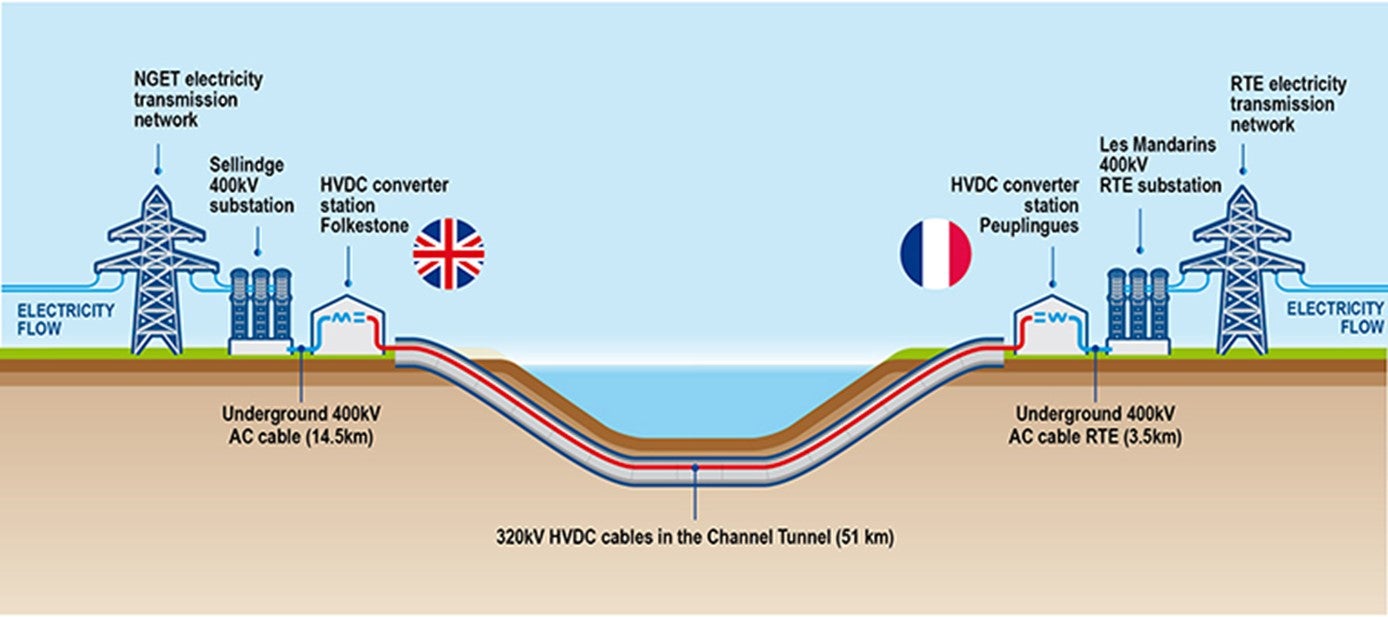

ElecLink is a 100%-owned, 1000MW electricity interconnector running inside the Channel Tunnel to provide bi-directional transmission capacity between France and the UK. This is distinct from alternative cables that are typically built on or under the sea floor. ElecLink has been designed to improve security of supply, enable higher levels of French nuclear and renewables to penetrate the UK grid, avoid building new peak generation capacity in the UK and increase European energy market integration. ElecLink has received a 25-year regulatory exemption that will allow it to sell long-term contracts for capacity in both directions.

ElecLink also supports the development of a low-carbon economy, which requires an increase in exchanges on a European scale to adapt to the development of intermittent renewable energy on the supply side and meet the growth in electricity demand. Getlink has also issued Green Bonds to help finance the ElecLink project. After 10 years of planning, regulatory processes and construction, ElecLink became operational on 25 May 2022.

ElecLink generates value for Getlink through the sale of electricity capacity via capacity auctions to third parties – being electricity market participants. The key drivers of the revenues for ElecLink are the electricity price spreads between the UK and French power markets, the volatility in the prices and the tenor of the contracts sold over time.

Source: Getlink. January 2022

As at 30 June 2022, the asset is less than two months into operations and most of the capacity has been sold in day-ahead tenders. However, Getlink’s management team has been progressing to shift capacity auctions to longer term, which will smooth earnings, and the company expects that more than 50% of capacity will be sold in longer-term contracts by the end of 2022.

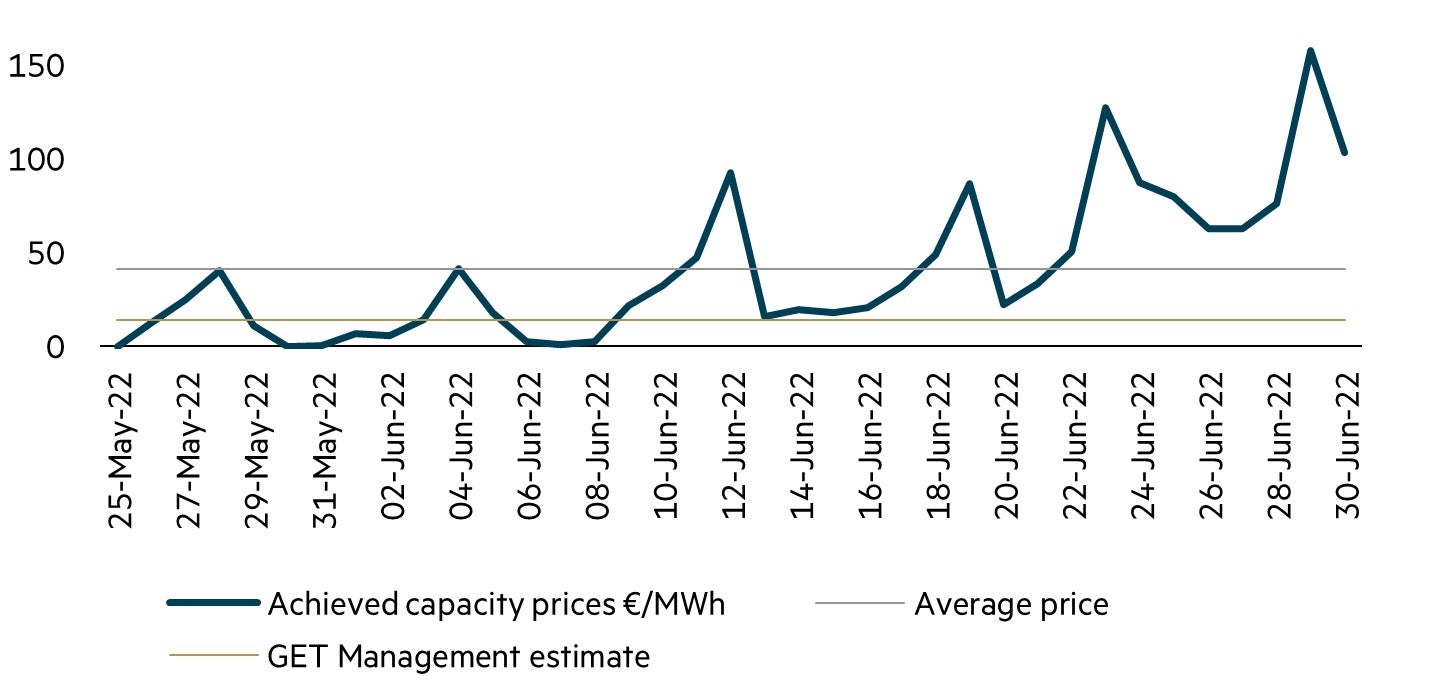

ElecLink day-ahead electricity capacity prices €/MWh

Source: ElecLink achieved capacity prices from JAO https://www.jao.eu/auctions#/ (EL1-GB to FR) as at 30 June 2022. Average capacity price based on MBA GLI estimates using achieved prices since operational commencement. Getlink Management estimate implied from rolling theoretical congestion rent revenue estimates from management business case as at 19 June 2018 (GET Investor Day presentation p69).

Since operations to 30 June 2022, the average price achieved on day-ahead contracts was more than €40/MWh (megawatt hour). ElecLink has also held longer-term capacity auctions, including selling forward 15% of capacity for 4Q22 at a significant €170/MWh, more than 10x the capacity price forecasts for congestion rent revenues put to the market in management’s business case at their 2018 investor day. As at 30 June 2022, Eleclink had already sold 29% of 2H22 capacity, which alone will generate €122 million of revenue. For context, Getlink’s entire business generated average half yearly revenues of €500 million to €540 million pre-COVID. Subsequent to period end, ElecLink also sold 150MW of 2023 annual capacity at €68/MWh. ElecLink cost Getlink ~€817 million in capital expenditure and capitalised interest over the years of construction (to 30 June 2022).

Several factors have contributed to the higher-than-historical electricity spreads we are witnessing. These include baseload shutdowns, economic rebound, higher renewables, nuclear outages and Russia’s invasion of Ukraine. While hard to predict, we believe elevated levels of volatility will persist, as intermittent renewables contribute to a greater share of the electricity generation mix and thermal baseload capacity is gradually phased out from the system.

During the construction period, Getlink guided the market to ElecLink contributing €80 million in EBITDA annually relative to €560 million group EBITDA in 2019 (pre-COVID). However, the option value we have long seen in this electricity transmission asset is now being realised by the market. Current electricity market conditions coupled with the significant growth in renewable electricity generation driving greater volatility since the project was initially scoped means ElecLink’s contribution to the Getlink group level EBITDA is likely to be much greater than previously envisaged.

As governments in Europe and the UK implement increasingly stringent laws, regulations and policies to accelerate the pace and scale of decarbonisation, we believe Getlink is well-positioned to weather these crosswinds. Getlink and ElecLink are reflective of the types of assets held in the broader GLI strategy, which is positively tilted towards companies and assets that facilitate, and stand to benefit from, the energy transition.

Our ESG engagements with Getlink

In 2021, we engaged with Getlink on its approach to climate change, emissions management and ESG reporting. By holding a position in the stock for a number of years, we have established a strong working relationship with the company and have previously engaged with them on matters such as Brexit and corporate governance.

As part of our engagement efforts, we undertook various 1:1 meetings with C-suite representatives and Board members, produced a presentation containing specific recommendations and summarised our position through formal letters.

Over the course of 2021 and 2022, we were pleased to see material outcomes from our engagement efforts. Among a raft of measures, Getlink made a commitment to produce climate change risk reporting, establish an interim emissions target with Science-based Targets Initiative (SBTi) accreditation and establish a goal to work towards carbon neutrality by 2050.

We are pleased with the company’s responsiveness. Aside from contributing to better environmental outcomes, we believe these actions help strengthen the company’s position in the market as a low carbon transport solution, relative to short-haul flying and ferries.

Related resources from Maple-Brown Abbott Global Listed Infrastructure

- A unique opportunity in the clean energy transition

- Finding opportunities in the topsy turvy world of transportation infrastructure

* +92% total shareholder return over five years and +29% over one year to 30 June 2022

Disclaimer

This material was prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is registered as an investment advisor with the United State Securities and Exchange Commission under the Investment Advisers Act of 1940. This information is provided for information purposes only. This material does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This material does not constitute an offer or solicitation by anyone in any jurisdiction.

This material is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this material does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. This information is current as at 21 July 2022 and is subject to change at any time without notice.

© 2022 Maple-Brown Abbott Limited