As the world continues to decarbonise, there is no doubt that electrification will play an indispensable role. However, there is also increasing recognition that reaching net zero emissions cannot be achieved through electrification alone. Hydrogen is currently viewed as a versatile energy carrier in a low-carbon future and a promising solution to displace the role of fossil fuels as. This is because hydrogen can be produced carbon-free through the process of electrolysis (known as green hydrogen), is a long-duration store of energy and has a variety of potential applications in sectors which are difficult to electrify. Applications include production of steel, fertiliser, and e-fuels for shipping, aviation and other heavy transportation industries.

Europe is at the forefront of the world’s clean energy transition. The EU first adopted its strategy on hydrogen in 2020, and in 2022 agreed on the REPowerEU Plan, which sets a target to domestically produce 10 million tonnes and import another 10 million tonnes of renewable hydrogen by 2030.* Given these developments, we recently attended a hydrogen conference in Copenhagen, Denmark to gain insights from industry experts across the value chain on the investment outlook for hydrogen infrastructure in Europe.

Significant near-term investment required in renewable generation, but less in hydrogen transportation

Renewable energy is a necessary input into the production of green hydrogen (representing between 40-70% of the levelised cost of hydrogen**), so the ability to access low-cost renewable power is essential in creating a hydrogen economy. As a result, significant investment in renewables will be required for hydrogen production, beyond the existing need to replace fossil fuel generation. Denmark, which has one of the highest share of energy from renewables in Europe, is positioning itself to be an exporter of hydrogen with a goal to reach 4-6GW of electrolysis capacity by 2030.*** To support this ambition, the Danish Energy Agency is expected to tender for over 14GW of new offshore wind capacity by the end of 2023, which compares to the 2.3GW of offshore wind capacity currently installed.****

In contrast, the near-term investment opportunities for hydrogen transportation infrastructure appears to be more limited. Initial phases of hydrogen projects will largely be located within industrial/commercial hubs to minimise transportation costs. In the case of intra-EU exports, the most economical solution is through the repurposing of existing natural gas pipelines, which are expected to be low capital investment opportunities at an estimated 10-15% of the cost of a new build pipeline. Putting these investments in context, Green Power Denmark estimates that the first phase of Denmark’s hydrogen investments will require approximately €20 billion invested in renewables and electrolysers compared to only €2 billion in transportation infrastructure.^

More European government support is needed to meet hydrogen ambitions

In our view, the green hydrogen economy remains nascent and requires significant support from government to reach the target set in the REPowerEU plan. The industry estimates that reaching 10 million tonnes of domestic production will require electrolyser capacity of 90-100GW, which compares to current European manufacturing capacity of only 1.75GW per year.^^ In addition, the current levelised cost of green hydrogen is estimated at €4-5/kg, which remains above the cost of hydrogen derived from fossil-fuels with carbon capture and storage.^^^ Some industry players have suggested that the Danish transmission system operator’s estimate of €2-3/kg by 2030 will prove challenging to achieve.^^^^

In addition to the ongoing support needed to accelerate renewable development, measures should be targeted at increasing both the demand for and supply of green hydrogen. On the demand side, proposed measures include increasing the renewable fuels requirement of end-users, establishing green hydrogen auctions to support price discovery and developing a common framework to define different types of hydrogen production and their carbon footprints. On the supply side, the industry is calling for an acceleration in the state aid approval processes, greater support for investment in domestic electrolyser manufacturing, as well as establishing common safety standards with regards to the handling and transportation of hydrogen.

Without the right support, there is a real concern that Europe may risk falling behind the US on the development of a hydrogen economy given the generous incentives and simplicity of the US Inflation Reduction Act (IRA). A common criticism of the European energy transition is that while the region has ambitious decarbonisation targets, it lacks simple and efficient instruments to incentivise investment. It has been our experience, that in Europe, projects go through a tendering process where they are assessed on their merits to determine whether they should qualify for funding available at the national or EU-level; whereas in the US, projects simply need to meet pre-determined requirements to access funding under the IRA.

Meaningful displacement of natural gas in Europe remains challenging

Beyond the twin challenges of rapidly scaling up renewable generation and improving government support for hydrogen, which in theory may be addressed in the near-term, technical challenges to scaling up the hydrogen economy Remain. These largely relate to the scarcity of water and limited hydrogen storage, both with no obvious solution.

The process of electrolysis requires ultrapure water to protect against corrosion and maximise the performance of the electrolysers. However, with 29% of EU territory already affected by water scarcity and potentially worsening through climate change, this could be a limiting factor to scaling hydrogen production in some locations.+ Given that it takes roughly 10 kilograms of pure water per kilogram of hydrogen produced, at scale this will compete with other uses of clean water. The industry expects treated wastewater to be an attractive solution because it doesn’t compete with other water uses and its treatment is generally less energy intensive than for surface or sea water.

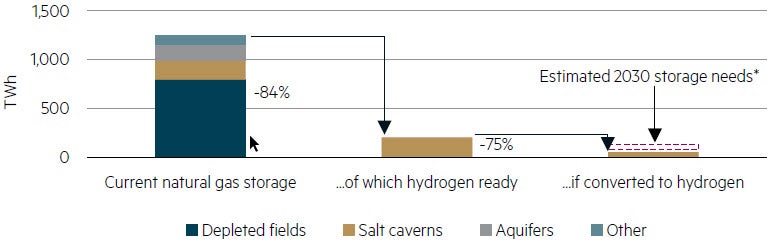

In our view, however, the bigger challenge will be the limited availability of long-term hydrogen storage, which will severely limit its ability to provide the seasonal flexibility to displace natural gas. Europe’s current underground natural gas storage – primarily comprising of depleted fields, salt caverns and aquifers – provide over 1,200TWh of seasonal energy storage potential.++ Across these technologies, only salt caverns are commercially ready for hydrogen because it is impervious, whereas aquifers and depleted fields contain porous rocks and other elements that result in losses from leaks and chemical reactions with hydrogen. This limitation, along with the lower volumetric energy density of hydrogen compared to natural gas, means that only 4% of the energy content that can be stored in the form of natural gas today in Europe can be stored in the form of hydrogen. This is well short of the region’s seasonal energy needs. Moreover, it can take between 5–7 years to convert an existing natural gas salt cavern to hydrogen, which limits the speed at which the region can transition away from fossil fuels.

Underground European energy storage potential from conversion to hydrogen

Source: Storengy, 15 June 2023. * Assuming 10-15% of demand under REPowerEU

In summary

The nascent market for green hydrogen faces significant political, regulatory and technological challenges, even in Europe which is at the forefront of the energy transition. While the current infrastructure investment opportunities directly related to the production, transportation and storage of hydrogen remain limited, we instead see strong opportunities to invest in the growing need for renewables that will be necessary to meet decarbonisation goals, and ultimately facilitate a green hydrogen economy. We expect renewable developers like Orsted (the leader in global offshore wind development), Energias de Portugal (EDP) and SSE, who all have strong renewable development pipelines, as some of the best positioned companies on this front. We expect governments to continue supporting the industry as they continue to close the gap between ambition and reality, and as they compete for capital globally.

Finally, we continue to believe that the energy transition will need to be balanced to ensure energy security and affordability are also maintained. While hydrogen has the potential to be a low-carbon energy carrier, we see some challenges that may be difficult to overcome in the short to medium-term, which will likely underpin the role of natural gas in the energy system for the foreseeable future. This supports the role of US natural gas infrastructure companies, such as pipeline operators Williams Companies and Enbridge Inc, and US LNG exporters, such as Cheniere Energy and Sempra.

* RePowerEU Plan, European Commission, 18 May 2022.

** Lazard’s Levelized Cost of Hydrogen Analysis

*** The Government's strategy for POWER-TO-X, Danish Ministry of Climate, Energy and Utilities, 2021.

**** Press release: Market dialogue regarding the new tender framework, Danish Energy Agency, 31 May 2023.

^ Stryg, M (2023), ‘What regulations need to be passed to boost whole value chain development?’, Green Power Denmark presentation at the Fortes Hydrogen & P2X 2023 conference, Copenhagen, 14 June.

^^ European Electrolyser Summit: Joint Declaration, European Clean Hydrogen Alliance, Brussels, 5 May 2022.

^^^ Hydrogen Economy Outlook: Key messages, BloombergNEF, 30 March 2020.

^^^^ Pathways towards a robust future energy system, Energinet, November 2022.

+ Water scarcity conditions in Europe, European Environment Agency, 13 January 2023.

++ Gras C (2023) ‘Hydrogen storage On the critical path to deliver ambitious hydrogen strategies’, Storengy presentation at the Fortes Hydrogen & P2X 2023 conference, Copenhagen, 15 June.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 7 August 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.