In recent times, the cost of living in Australia has grown faster than salaries, meaning ‘real’ wages have gone backwards. We believe this is about to reverse as the lagging effect of Australia’s employment regime abates. This should fuel material wage inflation over the next 6-12 months despite signs that the labour market may be softening. As a result, we expect to see Australian small cap companies increasingly divide between those that can cope with rising wages using pricing power, cost cutting and/or productivity initiatives – and those that can’t.

Is wage inflation being underestimated by the market?

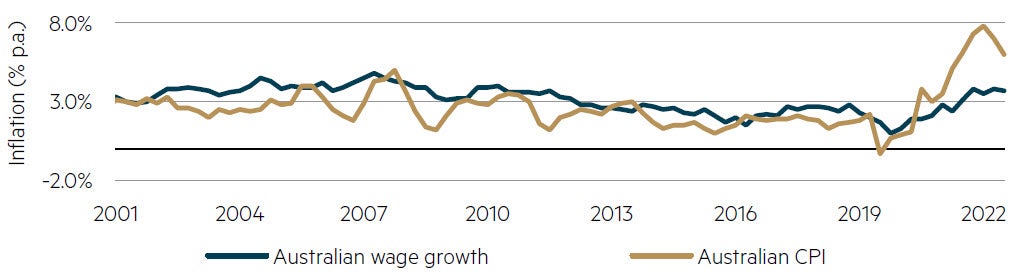

A consistent theme coming through for most sectors across the Australian small cap universe is wage inflation. We believe wage inflation is trending higher, however this is yet to materially show up in official government statistics, which currently show wage growth tracking below the Consumer Price Index (CPI).

Australian wage and consumer price inflation (% p.a.)

Source: Australian Bureau of Statistics - All groups CPI (%), Total hourly rates of pay including bonuses index, June 2023. www.abs.gov.au/statistics

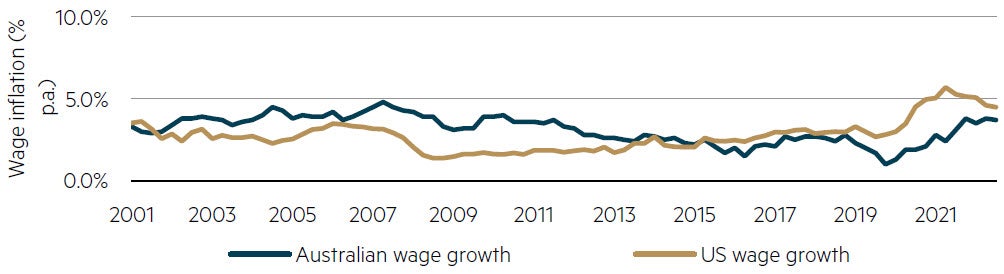

In addition, systemic rigidity has contributed to Australian wage growth lagging the rest of the world. The minimum wage / award wage, which impacts over 20% of the Australian workforce(1), is set by the Fair Work Commission (FWC) and only resets annually on 1 July each year. Enterprise Bargaining Agreements (EBAs), which impact approximately 35% of the workforce(2), typically lock in wage growth rates for a period of up to four years(3). The duration of standard EBA contracts means many Australians are still ‘stuck’ in employment agreements negotiated as far back as pre-Covid. This significant lagging effect stands in contrast to almost every other developed economy, where wage increases have washed through much earlier.

Australian and US wage inflation (% p.a.)

Source: Australian Bureau of Statistics – Total hourly rates of pay including bonuses index, www.abs.gov.au/statistics, Federal Reserve Bank of St. Louis – Employment Cost Index: Wages and Salaries: Private Industry Workers, Percent Change from Year Ago, Quarterly, Seasonally Adjusted, June 2023, https://fred.stlouisfed.org

The structure of Australia’s wage negotiation regime means wage inflation is predominantly a lagging indicator. The 5.75% minimum wage decision(4) announced earlier this year by the FWC applies from 1 July 2023 and we expect this hike will act as a benchmark for EBA renegotiations, and contribute to further acceleration in wages over 2HFY24 and into FY25.

This risk of further wage inflation is evident in the sharp increase in wage rates being set for new EBAs(5) with employees expecting annual wage increases to be even greater over the next 12 months as cost-of-living pressures persist.

This classic wage-price spiral is happening when the unemployment rate remains close to record lows, although we acknowledge a loosening in labour market tightness, as indicated by labour underutilisation (i.e. unemployment and underemployment)6), which has recently increased but remains well below pre-Covid levels. In addition, job vacancies remain elevated although below peak levels(7) and productivity weakness(8) is raising concerns that more significant wage inflation may be underway.

Recent government policies, including the Secure Jobs, Better Pay Bill(9), may deliver greater wage negotiation powers for trade unions and employees going forward. A recent example of this policy in action is G8 Education (GEM), a listed childcare operator, which is party to an application made to the FWC for multi-employer bargaining in the middle of both an ACCC inquiry and a Productivity Commission inquiry.

‘Application made to the Fair Work Commission (FWC) for Multi-Employer Bargaining in June 2023, facilitates tripartite negotiations between unions, employers and government, G8 voluntarily consented to be involved, FWC approved authorisation - September 2023, negotiation meeting agreed in November and December 2023’ G8 Education Ltd, ASX release from 2023 Strategy Day Investor Presentation, 26 October 2023.

In addition, the abolition of the Australian Building and Construction Commission (ABCC)(10), and companies increasingly focused on pay equality(11) and more flexible working arrangements(12) is expected to add further upward pressure on wages.

How to play wage inflation in the Australian small cap market

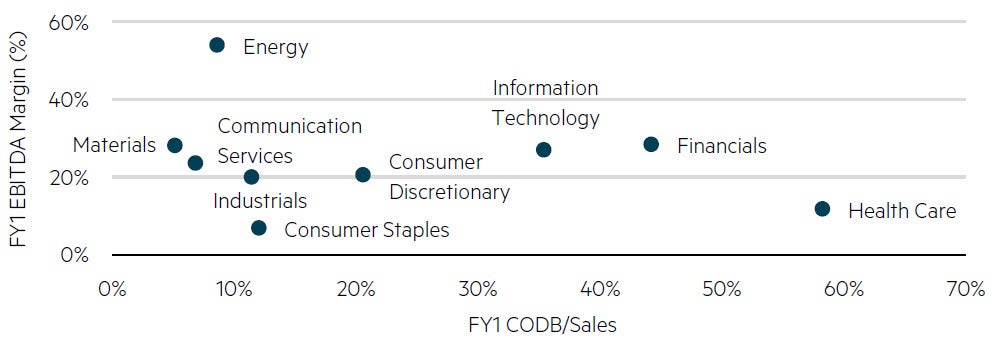

It’s no surprise that service-related sectors have the highest labour cost intensity, including healthcare and information technology. Conversely, commodity-related sectors tend to be less labour intensive.

Earnings Before Interest Taxes Depreciation Amortization (EDITDA) margin vs. Cost of Doing Business (CODB)/Sales forecasts for FY1 for the median stock in each Australian small cap sector

Source: FactSet, MBA estimates, N.B. consensus forecasts and classification in FactSet for different companies can vary.

Going forward, we expect there to be a materially adverse impact on sectors with minimal pricing power and high labour components as a percentage of sales. The notable standouts here are the healthcare and retail sectors.

In the healthcare sector, the listed radiology providers (such as Integral Diagnostics and Capitol Health) have been price-constrained by increases in Medicare reimbursements (approximately 1.6% in FY23 and 3.6% in FY24)(13) which lag cost inflation by approximately 12 months. This has resulted in material margin compression given labour as a percentage of total costs is high. This impact has been further amplified by increasing interest expenses given the gearing burden being carried by these companies.

‘Clinical staff shortages, particularly in regional areas, and cost inflation have continued into FY24 driving labour costs to be higher than expected, adversely impacting Operating EBITDA. As such we have not seen the expected Operating EBITDA margin improvement in Q1 FY24 relative to 1H FY23. IDX is responding to these pressures by accelerating productivity and efficiency initiatives.’ Integral Diagnostics Ltd, ASX release, 3 November 2023.

We prefer companies with a variable cost base and pricing power. Within the healthcare sector IVF providers stand out. Monash IVF Group continues to be a beneficiary of structural industry drivers including an older demographic, egg freezing and genetic testing. In addition, the company is currently seeing tailwinds from strong domestic industry IVF cycle volumes and price increases which are at or above underlying cost inflation – all of which we expect to result in operating leverage. In addition, we also prefer segments of the healthcare sector receiving additional government funding to support material wage increases, notably the aged care sector via exposure to Regis Healthcare.(14)

In the consumer discretionary sector, CODB/Sales is highly sensitive to like-for-like sales growth with low to mid-single digit sales growth needed to maintain current CODB margins – a target which is becoming an increasing challenge to hit in the current environment. Based on our research and industry feedback, retailers exposed to the youth consumer, including Accent Group and Universal Stores, are experiencing challenging top-line sales growth, coupled with wage inflation expectations of at least mid-single digit percentage growth. As sales growth softens, such firms are having to decrease service levels, including reducing staffing levels during non-peak trading periods, and further implement productivity improvements. Even with such tightening measures, we believe this won’t be enough to offset CODB/Sales pressures.

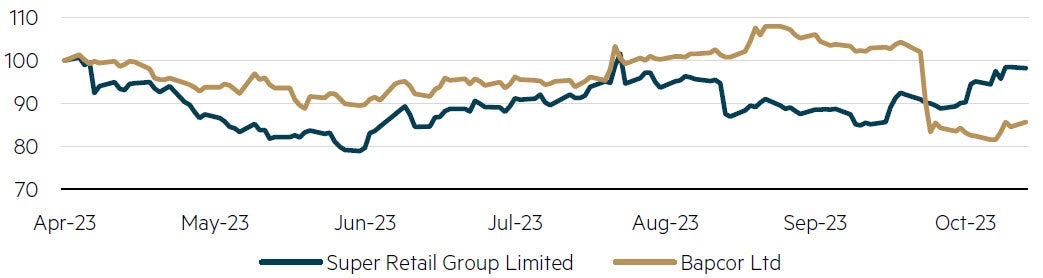

We are seeing increasing bifurcation in the performance of Australian small cap companies with similar industry exposures. Bapcor, which is skewed to non-discretionary consumer auto-related expenditure, is seeing slowing top-line sales growth which is compounded by increased margin pressure from cost inflation.(15) However, high-quality auto-related retailers are handling the current market environment better. For example, Super Retail Group has delivered accelerating FY24-to-date like-for-like sales growth since the release of the FY23 financial results in August, in an environment of CODB/Sales headwinds.(16)

Share price performance – Super Retail Group vs. Bapcor

Source: MBA, FactSet, data indexed to 100, 6 months to 6 November 2023. Past performance is not a reliable indicator of future performance.

The information technology sector is typically labour intensive, although this is often more than offset by high operating margins and pricing power. Companies including TechnologyOne and Hansen Technologies typically have annual CPI-linked pricing increases incorporated into their customer contracts which shields them from margin pressure in an elevated inflation environment. Based on our research and industry feedback, we expect margin expansion in select parts of the IT sector given the previous red-hot IT labour market from last year appears to be subsiding, and together with lower staff churn, should drive improving profitability in FY24 and beyond. There are also signs that labour shortages are easing in other sectors and companies, including Kelsian Group.(17)

Summary

In summary, we believe the delayed flow-through of wage inflation in Australia will have a material down-stream impact on the profitability of select sectors of the Australian small cap market over the next 6-12 months – which the market is under-appreciating. Specifically, we expect a material impact on sectors/companies with high labour components as a percentage of sales that have minimal pricing power and are riding abnormal post-Covid sales waves. As the market increasingly appreciates the impact of rising wages we expect to see an increasing bifurcation in the performance of ‘good’ and ‘poor’ businesses going forward. We believe the wage-price nexus creates a great environment for active management in the Australian small caps market and we continue to focus on investing in companies with genuine pricing power to offset lagged labour cost pressures.

(1) The national minimum wage only applies to a very small proportion of that workforce: only 0.7 per cent of employees are paid the national minimum wage. As for modern awards, approximately 20.5 per cent of employees are paid in accordance with minimum wage rates in modern awards. The Annual Wage Review Decision 2022-23, Fair Work Commission, 2 June 2023.

(2) The proportion of employees covered by enterprise agreements has decreased from its historical peak of 43.4 per cent in 2010 to 35.1 per cent in 2021, Enterprise Bargaining outcomes from the Australian Jobs and Skills Summit Regulation Impact Statement Department of Employment and Workplace Relations OBPR ID 22-03169.

(3) Enterprise agreements benchbook, Fair Work Commission.

(4) Minimum wages increase from 1 July 2023, Fair Work Ombudsman.

(5) Fair Work Commission.

(6) Australian Bureau of Statistics.

(7) ANZ job advertisements, ANZ.

(8) Australian Bureau of Statistics.

(9) Secure Jobs Better Pay Act.

(10) Abolition of the ABCC and ROC, Fair Work Commission, 12 December 2022.

(11) 2022–23 Gender Equality Reporting, Viva Energy and Workplace Gender Equality Agency, 13 June 2023.

(12) Four-day work week gains momentum – Medibank set to launch trial, Medibank Private, 23 October 2023.

(13) ‘Limited price increases with Medicare indexation of 1.6% well below inflation… indexation of 3.6% announced and applied to all Diagnostic Imaging Services, including MRI items however excluding Nuclear Medicine items, from 1 July 2023, with further indexation of 0.5% expected to be applied from 1November 2023.’ Integral Diagnostics ASX release FY23 Results Investor Presentation, 28 August 2023.

(14) ‘From the first full pay period on or after 30 June 2023, minimum award wages will increase by 15% in residential aged care for workers who are paid under the Aged Care Award and the Nurses Award in relation to the following occupations – personal care workers, recreational activities officers, head chefs and cooks (one FTE per service), assistants in nursing, enrolled nurses, registered nurses (including nurse practitioners) … Providers must pass on all the additional funding allocated to wage increases to their workers in the form of an increase in wages.’ Aged Care Worker Wages Guidance for aged care providers on the provision of funding relating to Stage 2 of the Fair Work Commission Aged Care Work Value Case, Australian Government Department of Health and Aged Care, June 2023.

(15) ‘However, we are not immune from shorter-term macroeconomic headwinds facing many organisations, which in the current financial year have so far led to a more moderate growth profile in our Trade and Wholesale markets, and a further deterioration in the Retail sector. This resulted in our overall year-to-date revenue growth slowing down to a low-single digit percentage rate, compared with last year. In terms of bottom line, these challenges are further compounded by increased short-term margin pressures from cost inflation and other external factors such as increasing payroll taxes … As a consequence, our year-to-date Pro-Forma NPAT at the end of September is behind the expectations we had at the beginning of the year, with the shortfall to our plans being in the mid-single digit millions of dollars’, Bapcor, ASX release 2023 Annual General Meeting, 17 October 2023.

(16) ‘I am pleased to report that in the first sixteen weeks of FY24, the Group has delivered sales growth of 4 per cent and like-for-like sales growth of 2 per cent, cycling 20 per cent like-for-like sales growth in the prior comparative period … As previously announced to the market, as a result of continued inflationary pressures on wages, rents and electricity costs, the Group expects its cost of doing business (CODB) as a percentage of sales to increase in FY24.’ Super Retail Group Ltd, ASX release from AGM Addresses, 25 October 2023.

(17) ‘The post COVID pressure of labour has been relieved. The new contracts in Sydney commenced fully staffed and Adelaide has returned to full staffing levels and overtime normalised… This part of the business is therefore on track to normalise temporary overtime costs by the start of the second half … As mentioned, we expect by the end of the first half, all businesses to be back to operating with more normalised levels of overtime following an extensive recruitment and training period.’ Kelsian Group ASX release 2023 AGM, 24 October 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (’MBA’). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 6 November 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.