Methane, the main component of natural gas, has long been touted a ‘bridge fuel’ to help decarbonise the global energy system and decrease emissions, especially through coal-to-gas switching. The emissions reduction benefits of making this switch can only be realised when fugitive emissions are actively managed to an absolute minimum.(1) We believe this methane ‘break point’ is often glossed over by companies and overlooked by investors researching companies in the energy sector.

While carbon dioxide (CO2) emissions have rightly taken centre stage of global efforts to mitigate global warming to date, methane emissions have largely slipped under the radar. According to the International Energy Agency, methane emissions are estimated to be responsible for around 30% of the global rise in temperatures to date.(2) It is clear they now warrant greater attention.

Ultimately, we believe the long-term outlook for natural gas remains uncertain and the risk of certain assets becoming stranded has increased as decarbonisation efforts ratchet up and fossil fuels are phased out in favour of renewables and electrification. We reflect this level of uncertainty in our valuations, in which we assign a higher probability to scenarios where gas networks will ultimately exhibit much lower growth rates.

While there are substantial uncertainties around the future for gas networks, technological advancements are opening up pivotal opportunities for gas networks to decarbonise and potentially be repurposed, for example, with green hydrogen and to a lesser extent renewable natural gas.

In the meantime, natural gas is still in the energy mix, and we believe companies have an imperative to manage methane emissions to mitigate the warming effects of this highly potent greenhouse gas (GHG). Otherwise, from our perspective, the switch from coal to natural gas does not result in a net benefit.

For this reason, methane has been a focus of our research and engagements with listed infrastructure companies, particularly with midstream companies and regulated utilities operating local distribution companies.(3) As we discuss later, some have either already reduced methane emissions significantly or have set themselves time-bound targets to manage these to a specified level. But more needs to be done.

Why is managing methane emissions important?

In August 2021, the Intergovernmental Panel on Climate Change (IPCC)(4) released its the Sixth Assessment Report. For the first time the IPCC called for an increased focus on tackling human-induced methane emissions to help steer the world towards the long-term temperature goal of the Paris Agreement.

According to the UN Environmental Programme, efforts to mitigate methane emissions over the next 10 years could mean the difference between a 2°C and 1.5°C world, with the energy sector offering the greatest potential for targeted mitigation by 2030.(5) Indeed, to limit global average warming to at least 2°C, methane emissions will need to be ~70% lower than today’s levels by 2030.(6)

Although less prevalent than CO2, methane is a GHG 86 times more potent than CO2 over a 20-year period.(7) Compared to CO2, which has potential to remain in the atmosphere for thousands of years, methane emissions have a relatively short atmospheric life span of around 12 years.(8) This spells a significant opportunity for policy makers and the private sector because rapid methane emissions reductions offers one of the quickest ways to slow global warming.(9)

Aside from the environmental impacts and the need to comply with increasingly stringent regulations, managing fugitive emissions is also financially beneficial for companies. Indeed, the International Energy Agency (IEA) estimates that ~73% of oil and gas methane emissions can be mitigated with existing technology. Of this, ~40% can be achieved at no net cost.(10) This is particularly true when natural gas prices are high.

In recognition of this imperative, in September 2021, the US and EU jointly announced the Global Methane Pledge – an effort to reduce methane emissions by at least 30% from 2020 to 2030 – alongside other countries such as the UK, Mexico and Argentina.

Companies taking action on methane

For midstream companies, the focus needs to be on the modernisation of long-haul natural gas pipelines (such as compressor station upgrades, capture of vented gas from maintenance activities and leak detection) and facilities, along with the development of renewable natural gas and green hydrogen capabilities to help minimise the full value chain of GHG emissions.

In the US, Williams Companies, a midstream pipeline business, has set a high bar (relative to its peers) on driving company-wide accountability for reducing its methane emissions. Progress towards Williams’ annual target “to reduce reportable releases by 10%”(11) comprises a 5% weighting in the company’s Annual Incentive Program for all employees, including the Chief Executive Officer and Chief Operating Officer. Since 2012, Williams has reduced reported methane emissions from its transmission compressor stations and processing plant operations by more than 41% to date. Williams is also actively pursuing opportunities in renewable natural gas and hydrogen to diversify their business models and support the energy transition as they work towards their net zero target by 2050.(12)

Duke Energy, a regulated multi-utility, has set a target to achieve net zero methane emissions by 2030. The company is eliminating all cast iron and bare steel main piping in its distribution operations, a major contributor to methane leakage. Duke Energy recently announced a partnership with Accenture and Microsoft to develop a cloud-based platform to measure baseline methane emissions from gas distribution systems using detection methods such as satellites, fixed-wing aircraft and ground-level sensing technology. The platform technology will help detect trace levels of methane with greater accuracy compared to traditional methods such as foot patrols and desktop estimates.(13) They are also working with their production and transportation suppliers to reduce upstream emissions too.(14) We regularly engage with Duke Energy on these initiatives to gauge progress.

Continued focus necessary

Actively managing fugitive methane emissions, particularly over the next 10 years, is critical to putting the world on a path to net zero emissions. Despite the ‘bridge fuel’ argument, the reality is that fuel switching is not a long-term option to mitigate global warming, since natural gas, completely combusted, still releases the equivalent of around 50–60% of the CO2 emissions that come from coal.15 This makes the long-term role of natural gas and ensuing methane emissions a key topic in our ongoing research and engagement with companies in the energy sector. We expect to see greater regulatory intervention drive progress over the coming years, particularly through the US Environmental Protection Agency and the EU as part of its range of green recovery measures.

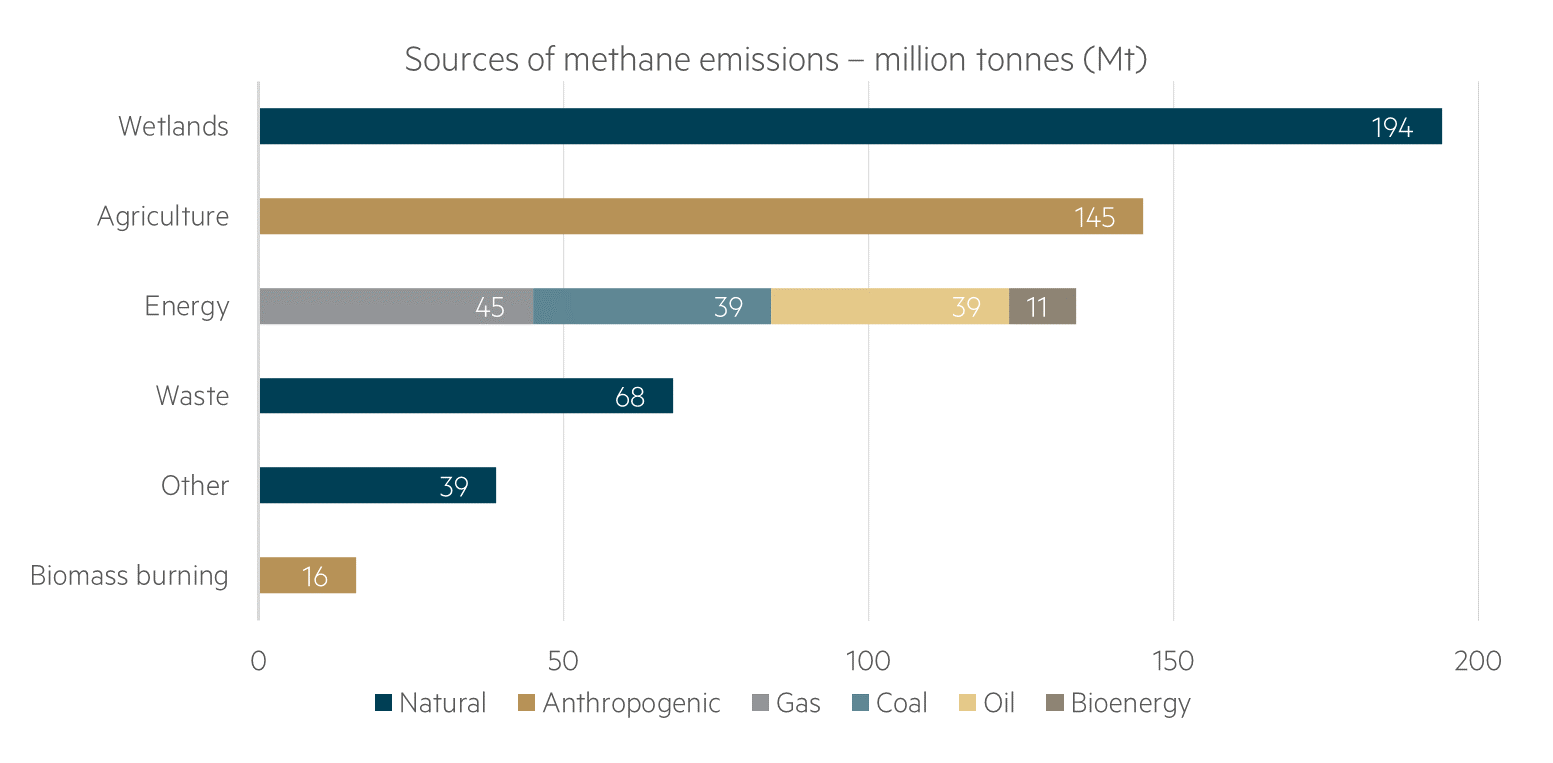

Source: IEA, ‘Sources of methane emissions’, 26 August 2020 www.iea.org/data-and-statistics/charts/sources-of-methane-emissions-2

1 Fugitive emissions are losses, leaks and other releases of methane to the atmosphere that are associated with industries producing natural gas, oil and coal. They also include CO2 emissions associated with flaring of excess gas to the atmosphere.

2 IEA, ‘Tackling Methane from Fossil Fuel Operations is Essential to Combat Near-term Global Warming’, Oct 2021.

3 Although of a smaller magnitude, methane is also a by-product of waste water and therefore also needs to be actively managed by water utilities.

4 The IPCC is the pre-eminent international body for assessing climate change science and informs the policy direction of parties to the Paris Agreement.

5 UN Environment Programme (‘UNEP’), ‘Global Methane Assessment: Executive Summary for Decision Makers’, May 2021, p.8 UNEP, ‘Global Methane Assessment: Benefits and Costs of Mitigating Methane Emissions’, May 2021, p.13.

6 According to the IEA Sustainable Development Scenario (2020).

7 Environmental Protection Agency. ‘Overview of Greenhouse Gases.’

8 IEA, ‘Driving Down Methane Leaks from the Oil and Gas Industry’, January 2021.

9 For instance, with rapid CO2 emissions reductions, global temperatures would not begin to cool for many years because of CO2’s long lifespan in the atmosphere. Methane has a more potent warming effect, but it is much shorter lived and therefore has a faster impact on average temperatures.

10 IEA, ‘Driving Down Methane Leaks from the Oil and Gas Industry’, January 2021.

11 Reportable releases refers to any type of reportable air releases determined by state regulations, including methane leaks.

12 Williams’ net zero emissions target relates to operational or “direct” emissions and does not include scope 3 emissions.

13 Duke Energy, ‘Duke Energy teams with Accenture and Microsoft to develop first-of-its-kind methane-emissions monitoring platform’, August 2021.

14 Sasha Weintraub, ‘Net-zero methane emissions is possible’, Duke Energy, October 2020.

15 This range depends on whether hard coal or lignite is being combusted. See Stefan Ladage, ‘On the Climate Benefit of a Coal-to-gas Shift in Germany’s Electric Power Sector’, Nature 11(11453) June 2021, p.1