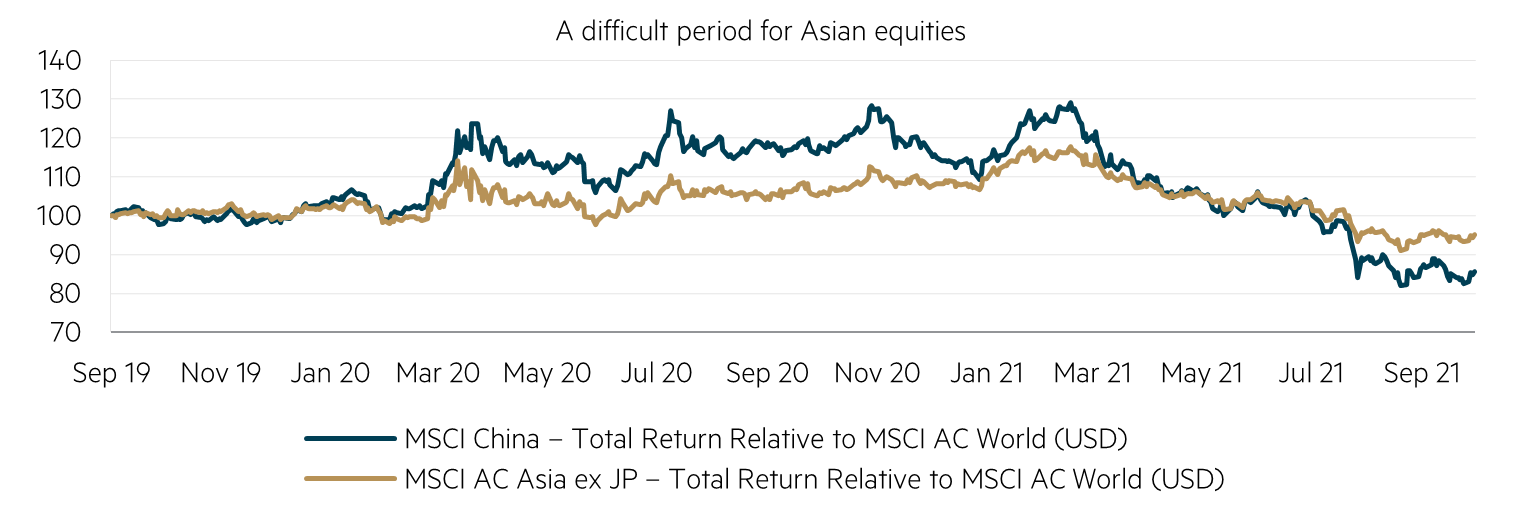

The September quarter was a difficult one for Asian equities, with the MSCI AC Asia ex-Japan benchmark falling 9.3% in US dollar terms. This marked its first quarterly decline since the beginning of the COVID-19 crisis in the March quarter of 2020. Although few markets across the globe avoided posting a negative return during the month of September, the Asia ex-Japan region was a significant laggard compared to the rest of the world over the quarter. Year to date, Asia has given back the relative outperformance enjoyed since the depths of the first COVID outbreak last year, falling 15% from its February 2021 high.

Viewing China as uninvestable a ‘disservice’ to investors

Regional returns continue to be heavily impacted by the weak performance of China, which was by some margin the worst performing major market over the quarter, falling 18.2% in US dollar terms. Foreign investors were heavy sellers in response to the ongoing regulatory crackdown impacting a range of companies and sectors, especially among the technology, education, gaming and fintech (including cryptocurrency) ecosystems.

A difficult period for Asian equities

Source: FactSet data to 30 September 2021

Sentiment deteriorated further during the quarter as China’s second largest property developer, Evergrande, moved closer to insolvency. On top of that, the country is experiencing its worst bout of power shortages and rationing since the breakneck days of the early 2000s when the economy was growing at over 10% and images of darkened skyscrapers in Shanghai captured the world’s attention. With China reliant on thermal coal for some 70% of its electricity needs and coal (and gas) prices reaching record highs, such brownouts are a powerful reminder of the challenge faced by policy makers in their desire to attain the stated goals of peak emissions by 2030 and carbon neutrality by 2060.

With liabilities in excess of US$300 billion, the market is right to be concerned regarding the potential spillover effects or contagion a disorderly collapse of Evergrande might have. While the next chapter for the company is yet to be written, we do not subscribe to the view held by some that this is likely to be China’s ‘Lehman Brothers’ or its ‘Minsky moment’.(1) As part of its wider strategy designed to rebalance China’s economy away from its debt-fuelled growth model, Beijing imposed a range of measures known as the ‘three red lines’ on the nation’s property developers last year. Such measures, which prescribe the maximum leverage a developer can retain based on three key solvency and leverage metrics, were always going to be problematic for Evergrande to meet. As such, its predicament should be viewed as a symptom not the cause of the current economic slowdown. Although there have been some precipitous declines across those stocks linked to the property sector, including financials and materials, both within and outside of China, it does not appear at this stage to have exposed broader systematic risks, with interbank funding rates (Shibor) and the renminbi remaining stable.

Meanwhile, the regulatory crackdown that started late last year in China intensified during the quarter. This led to an astonishingly sharp change in the consensus view toward China, particularly among the internet and ecommerce sectors. The banning of private investment in the after school tutoring industry, a data security investigation into Didi (China’s Uber) days after it listed, as well as further restrictions on minors playing online games were just some of the announcements made during the quarter.

While the portfolio had some exposure to online gaming companies, the overall impact of price moves was a positive contributor to relative performance, given the portfolio had minimal exposure to the most affected companies. The intensity of the current regulatory crackdown has been a surprise to the market, however we remain firmly of the belief that authorities do not want to destroy the broader sector (making China ‘uninvestable’ as some commentators have put it) but rather make it, and the broader economy, more sustainable in the longer term.

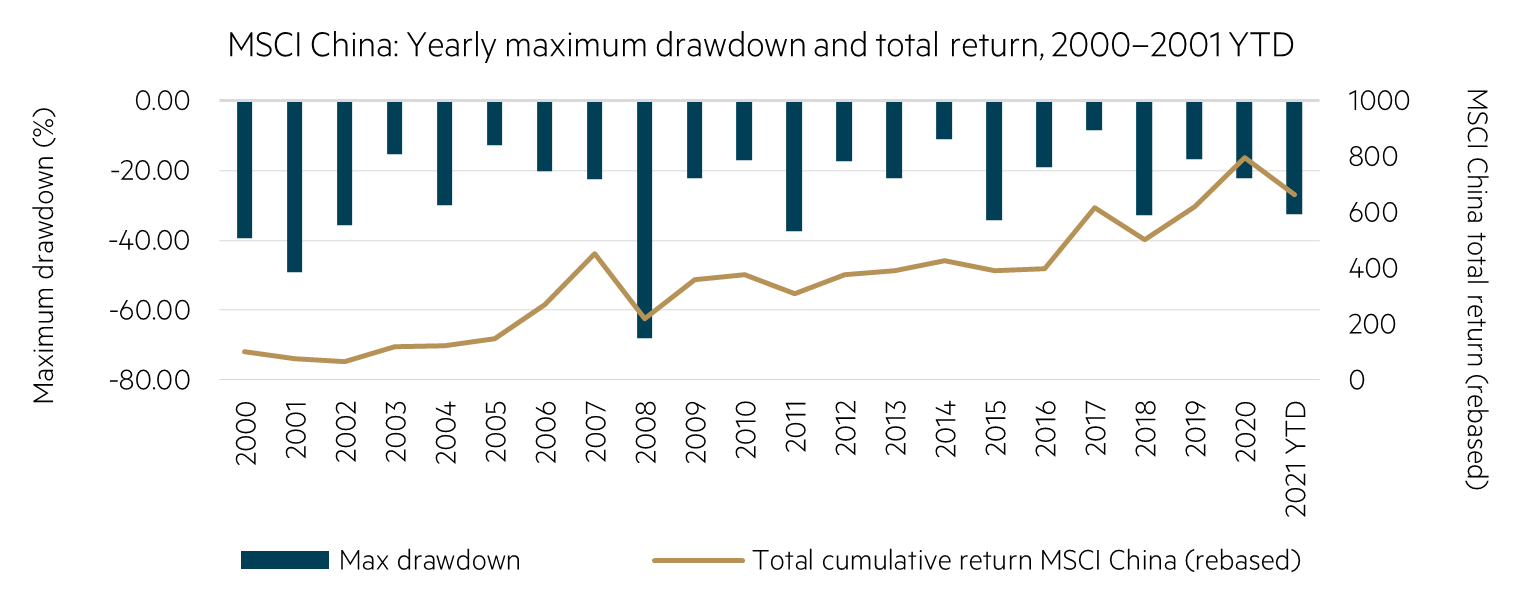

We also note many Western governments are grappling with similar issues with the rise of dominant tech giants. Volatility in China is not a new phenomenon. In fact, the MSCI China price index has corrected from peak to trough by more than 20% in 12 of the last 20 calendar years. We have used the increase in uncertainty and change in sentiment as a buying opportunity to selectively add weight to China, specifically Tencent and NetEase. We also initiated a small position in Alibaba for the first time in the strategy’s history. While the timing can never be known in advance, history suggests that the prevailing negative sentiment will not last forever with ‘animal spirits’ taking over, which will see the market recover.

Source: FactSet data to 30 September 2021

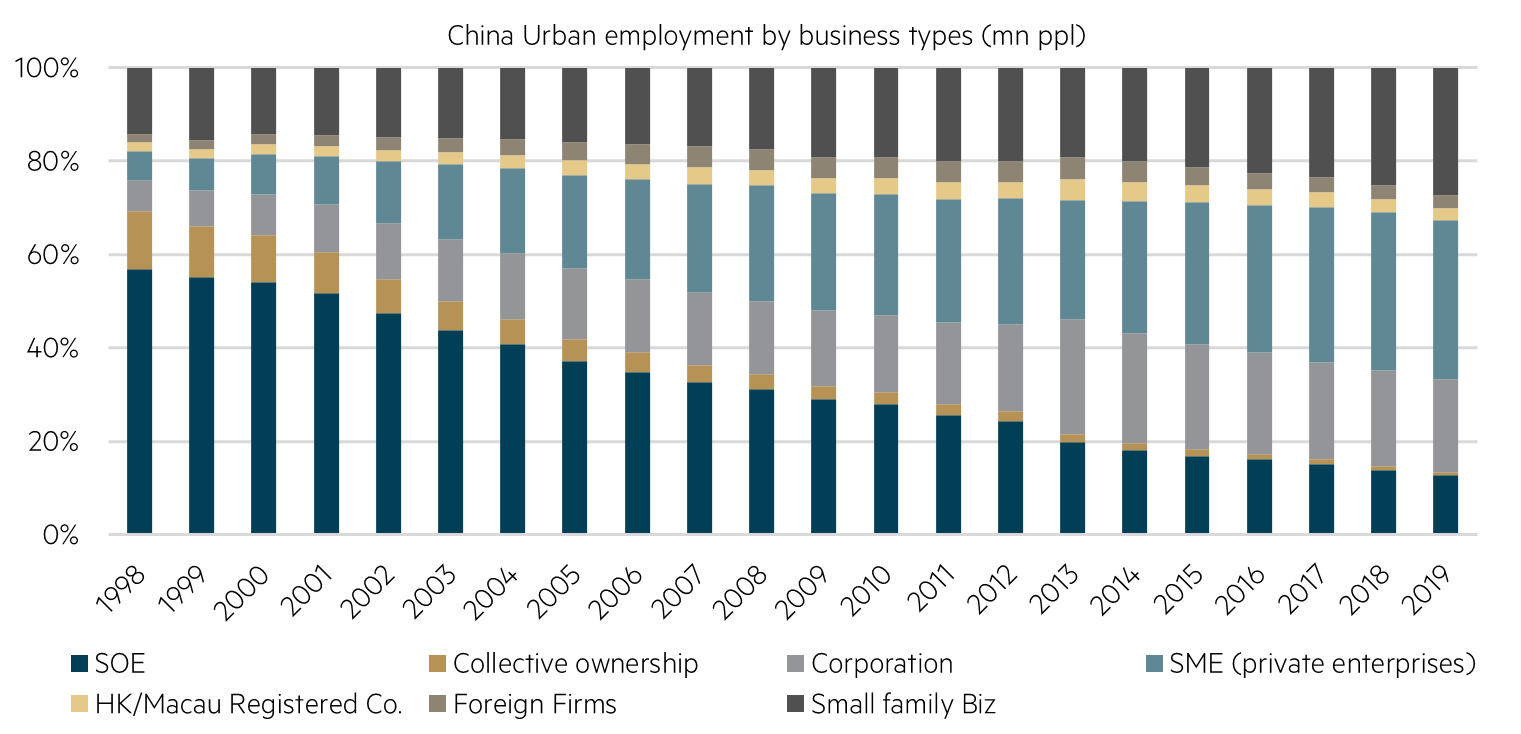

Private sector integral to China’s economic model

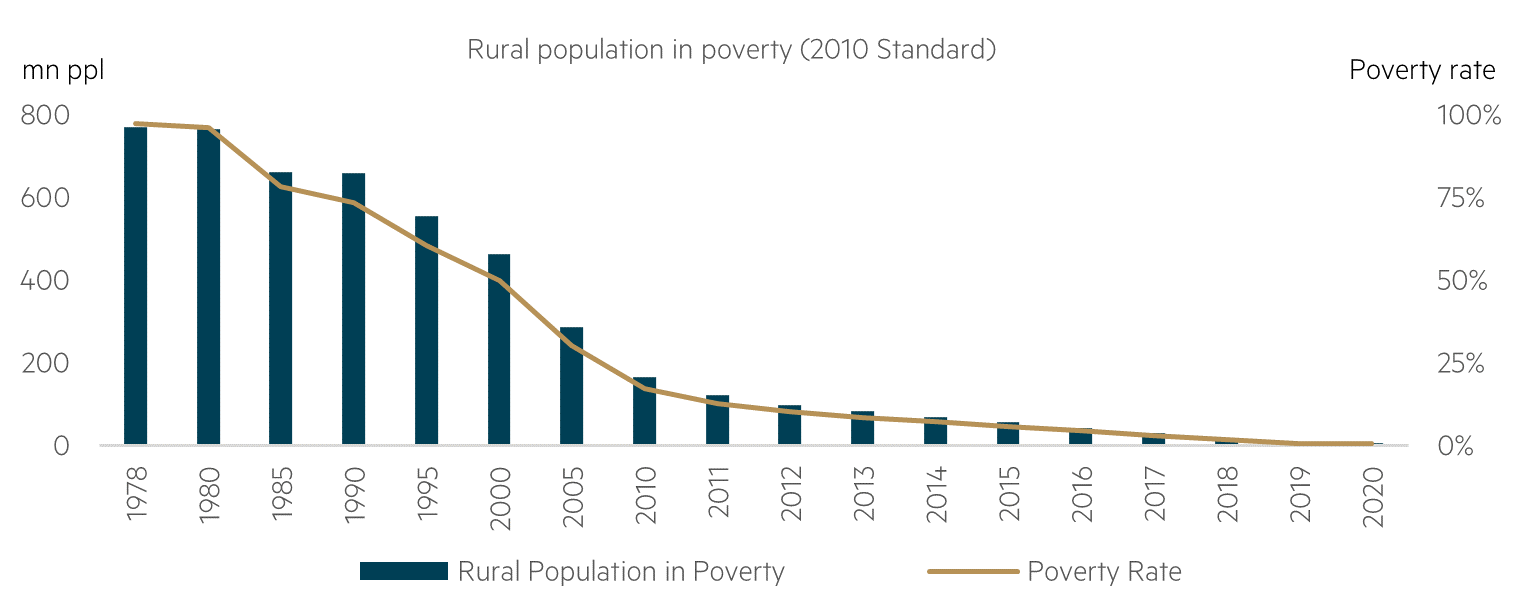

While it can’t be denied that the current regulatory overview being imposed on a range of sectors justifies some form of discount (assessed on a company-level basis), we do not believe that China is set to walk back from its decades-long process of market-based reform and close the ‘bamboo curtain’ opened under Deng Xiaoping more than 40 years ago. Put simply, the private sector is an integral part of modern China’s economic model. Accounting for some 60% of GDP and more than 80% of its urban employment, the private sector has played a crucial role in achieving China’s key policy goals of enhancing living standards and eliminating poverty. Similarly, if China has any hope of attaining its stated goal outlined in the current (14th) five-year plan of becoming a ‘moderately developed’ nation by 2035, it will do so only with the continued, and indeed, increased role of private enterprise. Many of its strategic objectives including the development of a domestic semiconductor industry, artificial intelligence and green technology will be developed by the private sector. This point was emphasised as recently as September when Vice Premier Liu He noted in a speech that “we must vigorously support the development of the private economy”.(2)

Private sector employment

Source: Wind

Source: Wind

With a middle-class population expected to number some 800 million by 2035, double its current level, China is likely to remain an engine room of global growth for many decades to come. Consequently, to ignore the investment opportunities available in the world’s second largest economy would be to inflict a great disservice on investors in our opinion. For now, however, it appears authorities in China are content with a lower pace of economic growth if it results in a reduction in income inequality and an improvement in capital allocation. Both are worthy outcomes if China is to achieve its long-term aspirations. Finally, it must also be noted that relative to the rest of the developed world, authorities in China have adopted a more conservative/orthodox approach to monetary policy in recent times that gives them greater flexibility. Apart from a single reduction in the reserve requirement ratio (RRR) in July, we have seen nothing like the stimulus observed elsewhere. With the one-year prime loan rate (LPR) at 3.75%, there is scope for authorities to move should conditions dictate.

Many segments of India back to pre-pandemic levels

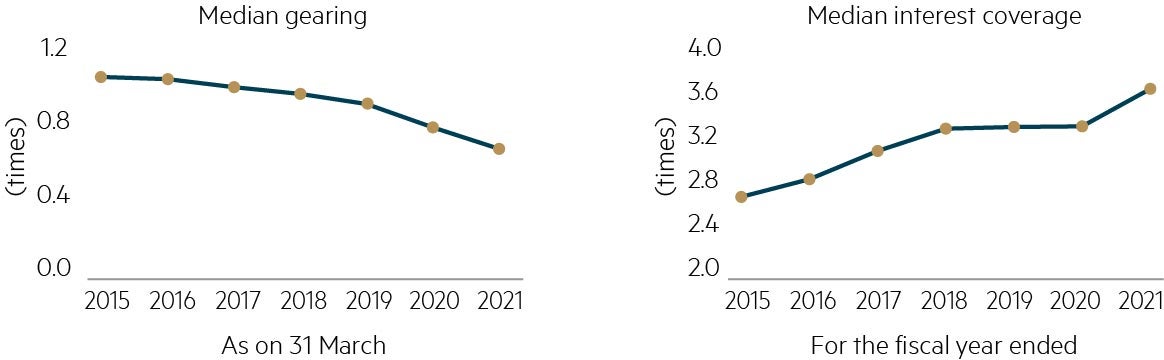

Elsewhere in the region, India continues to rebound strongly from its COVID-induced downturn experienced in the first quarter and was the strongest performing market across the region during the quarter, rising 12.6% in US dollar terms. The pace of recovery underway in the real economy is readily observable in a range of domestic credit metrics including recoveries, which in many segments have returned to their pre-pandemic levels. In its latest market update India’s leading credit agency CRISIL confirmed an improving trend in the country’s credit ratio.3 Encouragingly for our financial exposures in that country, CRISIL also noted the improving health of the corporate sector. However, rising energy costs are a clear risk for India given the country’s dependence on imported oil and gas and is something to be watched closely.

Indian corporates: financial risk profiles improving*

Source: CRISIL Ratings Limited

Positive sign for value investing in Asia

Going forward we expect market sentiment will continue to be impacted by news flow surrounding the pace of inoculations for COVID-19 across the region (especially within the ASEAN region) and the extent to which they support the ‘reopening’ of activity. The recently concluded earnings season supported expectations of a strong recovery in 2021 and decent growth of ~10% in 2022. Further, it is pleasing to see an increasing number of portfolio holdings exploit the recent weakness in share prices by instituting what we expect to be accretive capital management initiatives. As at quarter end, we estimate almost 30% of the portfolio’s holdings (by number) are embarking on some form of capital management activities designed to improve returns to shareholders.

In summary, it has been an eventful quarter for Asian markets, with a long catalogue of issues confronting investors. Volatility may well stay elevated in the coming months as the market digests the potential impacts of tapering across the region. While markets have had ample time to digest the potential for tightening monetary conditions, the outlook is further complicated by the clear inflationary pressures observed across supply chains in virtually every industry. Given how poor sentiment towards Asia remains among many global investors, it would not be surprising to see Asia rebound strongly in the months ahead should further bad news fail to eventuate.

On a positive note, the September quarter was rewarding for value investing as the portfolio managed to offset some of the decline observed in the broader market. We remain confident in the portfolio’s capacity to deliver an attractive return relative to the market given its superior valuation and balance sheet metrics.

Author

Geoff Bazzan

1 Hyman Minsky was a 20th century economist whose work focused on the self-correcting nature of business cycles.

2 Reported in China’s Liu He Reassures Private Businesses Rattled by Crackdowns in Asia Financial on 6 September 2021.

3 The ratio of upgrades to downgrades.

Disclaimer

This material was prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is also registered as an investment advisor with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. This information is intended solely for professional and institutional investors and is provided for information purposes only. This material is not intended for, and is not suitable for, retail clients and does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This material does not constitute an offer or solicitation by anyone in any jurisdiction.

This material is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this material does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. This information is current as at 30 September 2021 and is subject to change at any time without notice.

MSCI: The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com).