While the market weakness of the past six months or so might seem like a ‘vanilla’ market correction, it would be a mistake to think in those terms given the tumultuous changes that have occurred in global bond markets, with all manner of long-term downtrends being broken. In Australia, the pattern of lower bond rate cycle lows and lower cycle highs has been decisively broken and yields on 10-year bonds have risen to levels seen a decade ago. In the US, returns on 10-year bonds for the year to date are the poorest in six decades.* After these bond rate increases, investors are beginning to think bonds might potentially be an attractive investment. This matters significantly for the stock market, and especially for stock selection. Higher bond rates have already had a negative impact on the level of the market as they have on cross-sector returns. Stocks that have benefited greatly from exceptionally low interest rates (growth and tech in particular) have generally had a setback while commodity producers and other value sectors, such as some of the financials, have seen a turnaround. However, while the turn has been significant, it has been uneven and has left investors unconvinced that the winning sectors of the past decade won’t continue to be the future winners (after all, for many investors, this is all they have known). By all accounts, little new money has flowed to value managers in key markets while inflows into growth funds have picked up after the setback of the past year or so.

With the US market well into bear market territory (a greater than 20% fall from the peak), as at 30 September the ASX (ASX/S&P 300 Total Return) had yet to fall into that territory, though it had fallen ~15% from the peak by the end of the September quarter. The market moves during the quarter were typical of those of a bear market bounce with our market recovering ~60% of the losses from the lows seen in late June (by mid-August), before retreating later in the quarter to test the earlier lows. The market moves largely reflected the (inverse of) movements in the long bond rates, gaining strength as rates fell into August and then retreating as long rates again headed higher, recognising that inflation is likely to be a factor for some time to come.

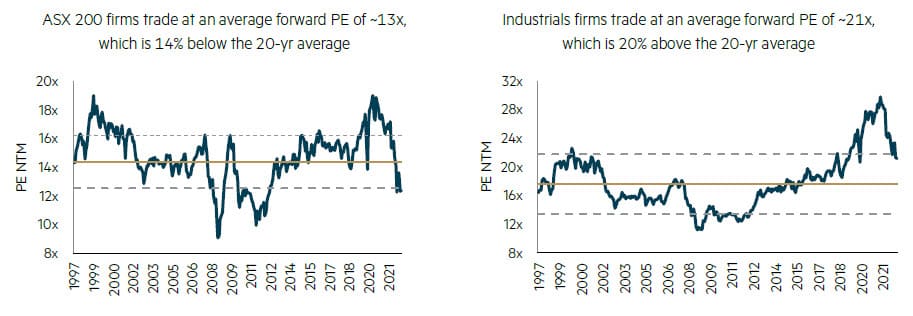

After the market setback Australia has experienced, our market at a headline level looks to be one of the least expensive of larger world markets, trading on a consensus forward price earnings (PE) multiple of ~13 times. However, this number is misleading given industrial stocks continue to trade at premium levels while resource PE multiples are heavily discounted (8 times earnings) as earnings appear to be at peak levels and forecast to decline.

Australian market PE broadly in line with historical averages

Industrials still expensive

Source: Goldman Sachs, data to 30 September 2022.

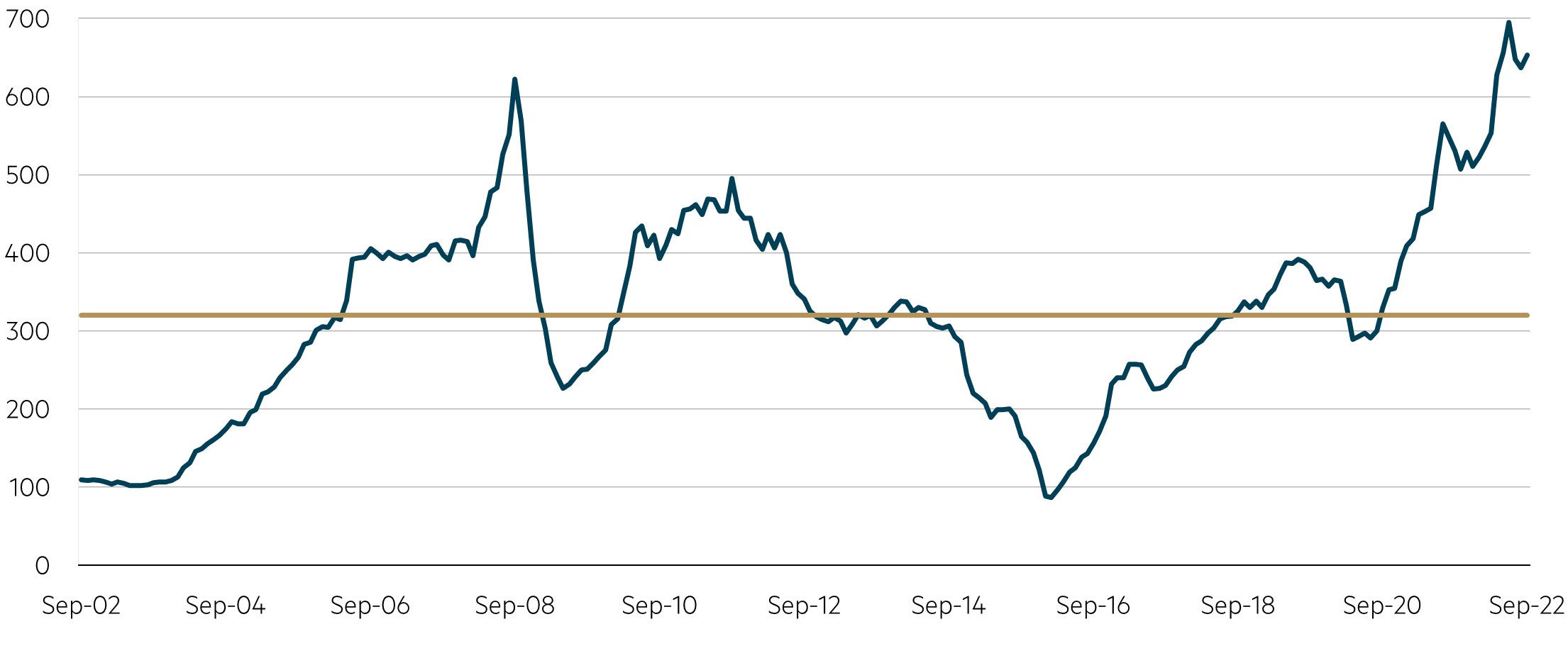

A key issue at hand is how much of a decline we should expect in resource earnings (refer to the following chart), with consensus forecasting a 20% decline to ~550 by December 2024. The difficulty forecasting in the current environment of high inflation, tightening monetary policy and the Ukraine war is highlighted by the fact that at the end of March the forecast for December 2024 was much lower at ~430 (-39%). We continue to be attracted to the energy and broader resources sector given the conservatism built in to share prices (even should market earnings expectations turn out to be overly optimistic), and by the largely pristine balance sheets that resource companies enjoy after a period of strong profitability.

S&P ASX 200 Resources – EPS (NTM)

Source: FactSet, data to 30 September 2022.

Turning to the topic of cross-sector returns, it is clear value stocks in general have performed well over the past 18 months or so, while sectors that have benefited from a decade and more of declining interest rates have struggled. Many market participants remain unconvinced this is sustainable and market strategists continue to write about the timing of a re-entry into growth stocks. In our view, such an approach suggests investors are failing to account for the dramatic change in investment fundamentals brought about by the rout in the bond market. Most agree that higher bond rates will compress the stock market overall but see limited impetus to change their approach to stock selection from the winners of the past decade – growth stocks.

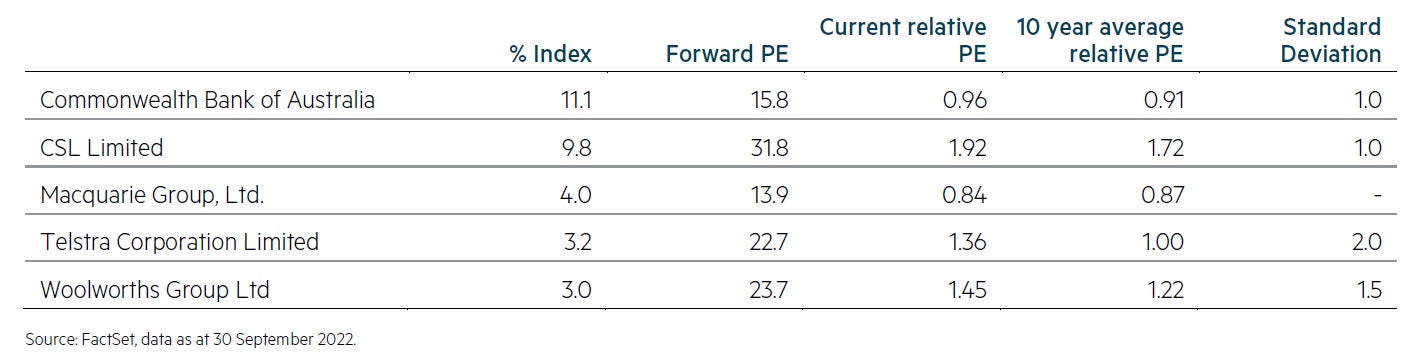

As we delve further into the stock selection debate, we note that at a headline level, most industrial companies look very expensive relative to their history when measured by their PE multiples relative to the broader market. However, at least part of the explanation is the peak profits currently being enjoyed by resource companies and the resulting low PE multiples they consequently trade on. For this reason, it is instructive to review the PE multiples of some of the leading industrial stocks relative to the Industrial benchmark, rather than to the broader benchmark including resources. This more accurately highlights the stocks that are trading at larger variations from their average multiples. We have chosen five of the 10 largest industrial companies in the Industrial benchmark to illustrate this.

S&P ASX 200 Industrials

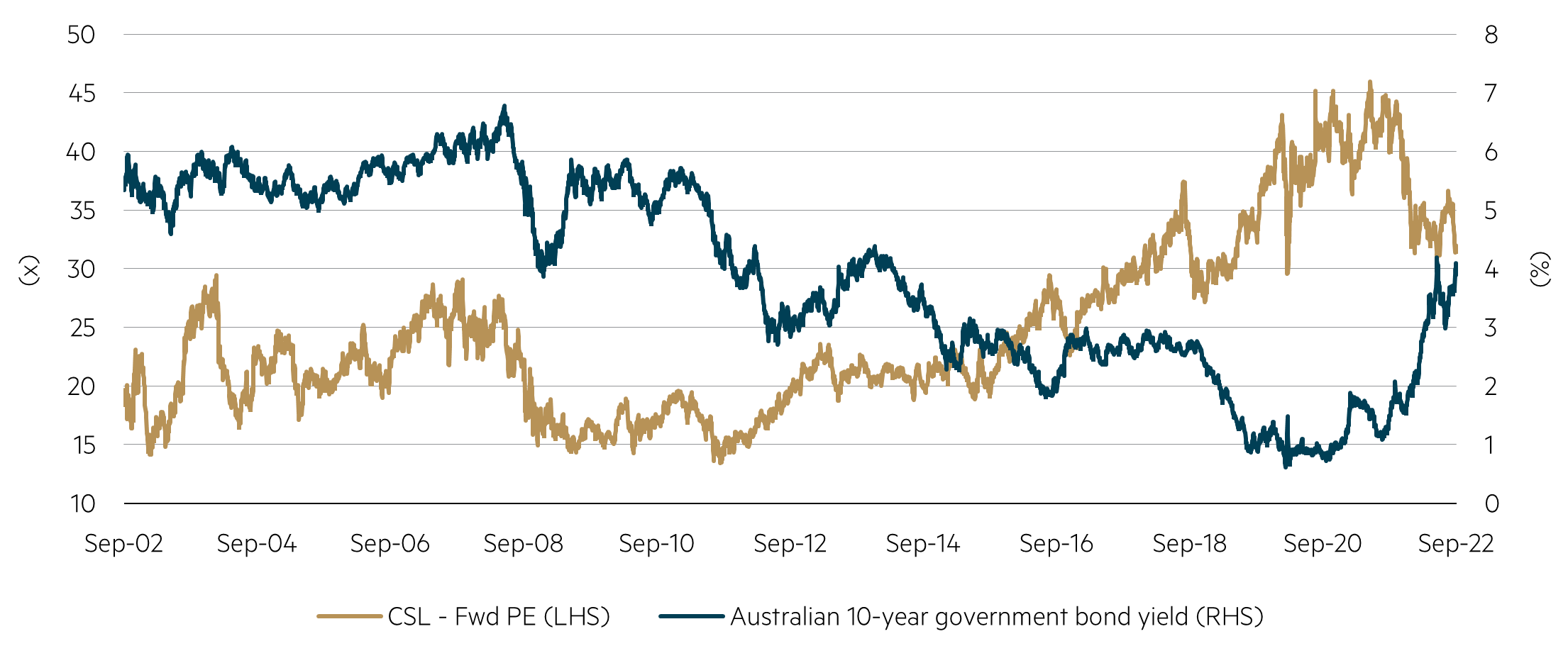

The table highlights that four of the five stocks are trading 1 to 2 standard deviations expensive relative to their 10-year history, highlighting the premium rating currently being enjoyed by many of the market favourites. CBA is one of the highest rated banks in the world, while CSL enjoys a rating afforded few other large health care companies globally. In that regard, it is worth highlighting that CSL’s PE multiple has expanded considerably over the past decade or so and looks set for further correction given where bond rates currently trade. The exception in this group is Macquarie which is trading in line with its history but on vastly higher earnings, which we expect to come under significant pressure in a less favourable market environment.

CSL’s PE multiple remains stretched in the face of rising rates

Source: FactSet, data to 30 September 2022.

Room for further outperformance for value stocks

Given the premium valuations still seen in many of the larger capitalisation industrial stocks, it seems likely that they will experience further downward pressure. Whether or not the overall market sees a similar outcome will depend to some extent on how commodity prices trade in this difficult environment and the impact they could have on the pricing of resource stocks. The magnitude of the moves seen in long bond rates globally does however suggest further stock market weakness is likely, even though some significant adjustments have already occurred. Value stocks have performed relatively well in this environment, and we believe there is room for further outperformance given valuations remain supportive relative to growth stocks.

* What Comes After a Week That Shook the World

John Authers, Bloomberg Business News, 23 September 2022.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information.