Harnessing the potential of listed and unlisted infrastructure

On the Global Listed Infrastructure team, we are frequently asked, “why listed infrastructure?” when the real question should be; “why infrastructure?”: From our perspective, the assumption that listed and unlisted infrastructure are two separate asset classes is a commonly held myth that needs to be debunked.

Listed and unlisted assets share the same physical characteristics, are subject to the same levels of regulatory oversight and have comparable levels of asset-specific management expertise. We believe it’s time to lift the lid on the inherent similarities and complementary differences between both investment routes so investors can harness the full potential of infrastructure as an asset class.

Common threads

Investors are typically drawn to infrastructure investments for their diversification and portfolio balancing qualities, reduced volatility relative to broader equities, diversification and strong cash yield with ongoing growth potential. Investors typically access the asset class in two ways - investing in securities listed on global exchanges; or investing directly in the assets themselves and/or through pooled investment vehicles. Anyone considering an allocation to the asset class should consider listed infrastructure alongside its unlisted counterpart to harness its full potential.

Our analysis of listed and unlisted airports, US electric utilities, and UK water utilities companies shows the common denominators of infrastructure assets remain the same. Both infrastructure assets share:

- the same physical characteristics

- the same regulatory oversight

- comparable levels of asset-specific management expertise.

Indeed, the same types of assets are accessible in both listed and unlisted markets (e.g. Melbourne and Sydney Airports) while some are available through both routes (e.g. Aleatica and APRR). Given the inherent similarities between the types of physical characteristics of both listed and unlisted infrastructure assets, we find it difficult to differentiate the two simply on the basis of ownership.

Complementary characteristics

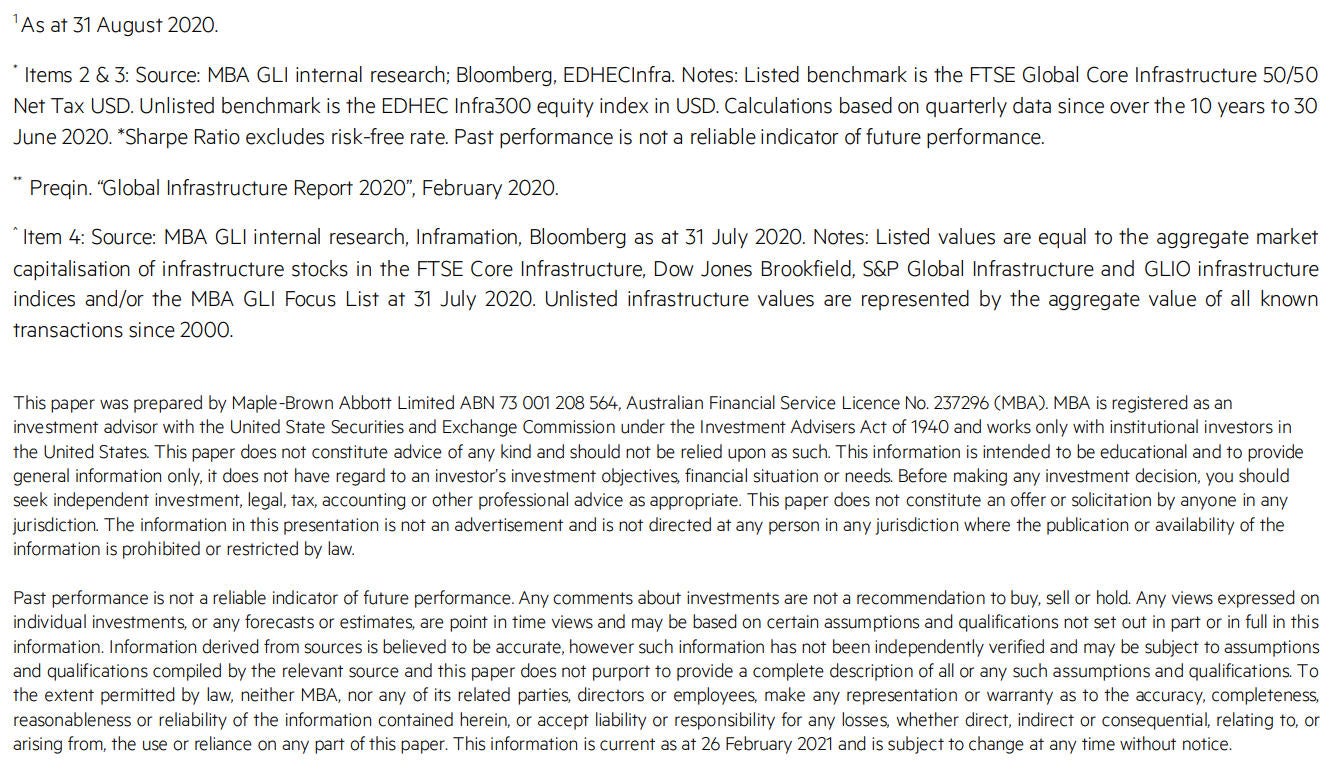

Rather than splitting infrastructure in two, closer attention needs to be paid to the inherent characteristics of listed and unlisted investments to find an allocation mix best suited to investors’ specific needs. Factors such as fees, liquidity and portfolio re-balancing requirements, risk exposures, diversification, cash flows, opportunity sets and, perhaps most importantly, risk-adjusted valuations are just some of the ways we believe investors should re-contextualise the breath of diversity within the asset class (see Item 1).

Lifting the lid on long-term returns

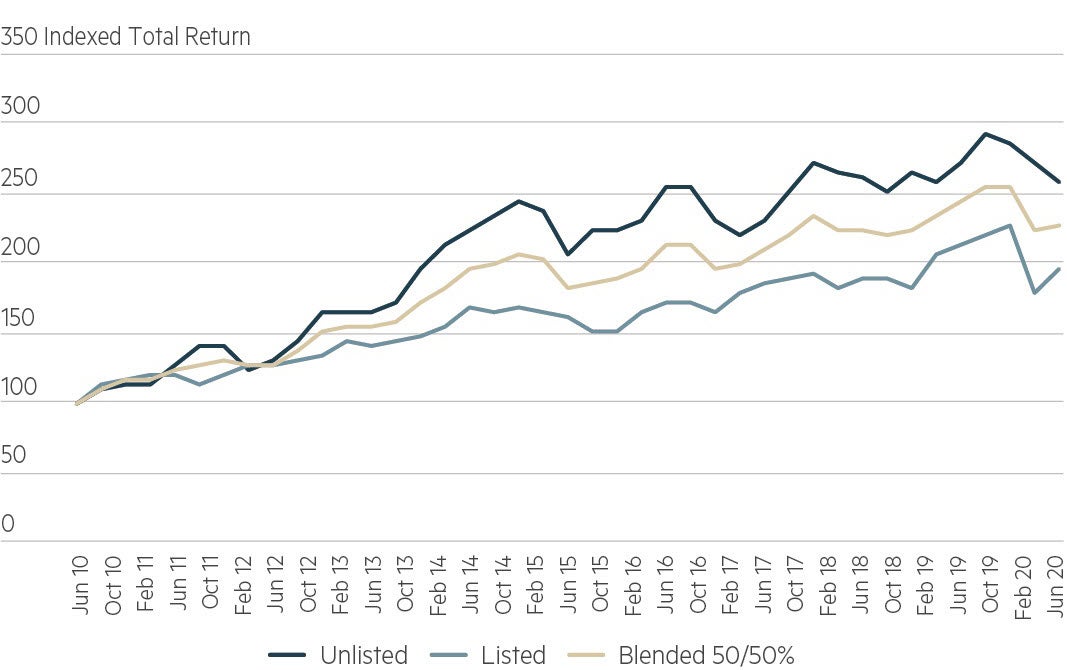

Some argue that unlisted infrastructure assets exhibit lower volatility and have outperformed listed assets over the long term. Investors should tread with caution when navigating through the information asymmetries that exist between the two investment routes. Comparing returns is not a clear-sighted approach. Our research identifies two key differences:

- Frequency of valuations: listed infrastructure is valued daily and is therefore influenced by market sentiment, resulting in short-term volatility. Unlisted infrastructure values, however, are based on periodic valuations of underlying assets, which typically occur on a quarterly basis and are based on valuation movements derived by an auditor or manager’s best estimate.

- Smoothed valuations: unlisted valuations are inherently smoothed because they lag the market. Relying on a smoothed basis for valuation, as do advocates of unlisted infrastructure as a standalone asset class, is in our view, a flawed approach to measuring the volatility of underlying assets or their cash flows.

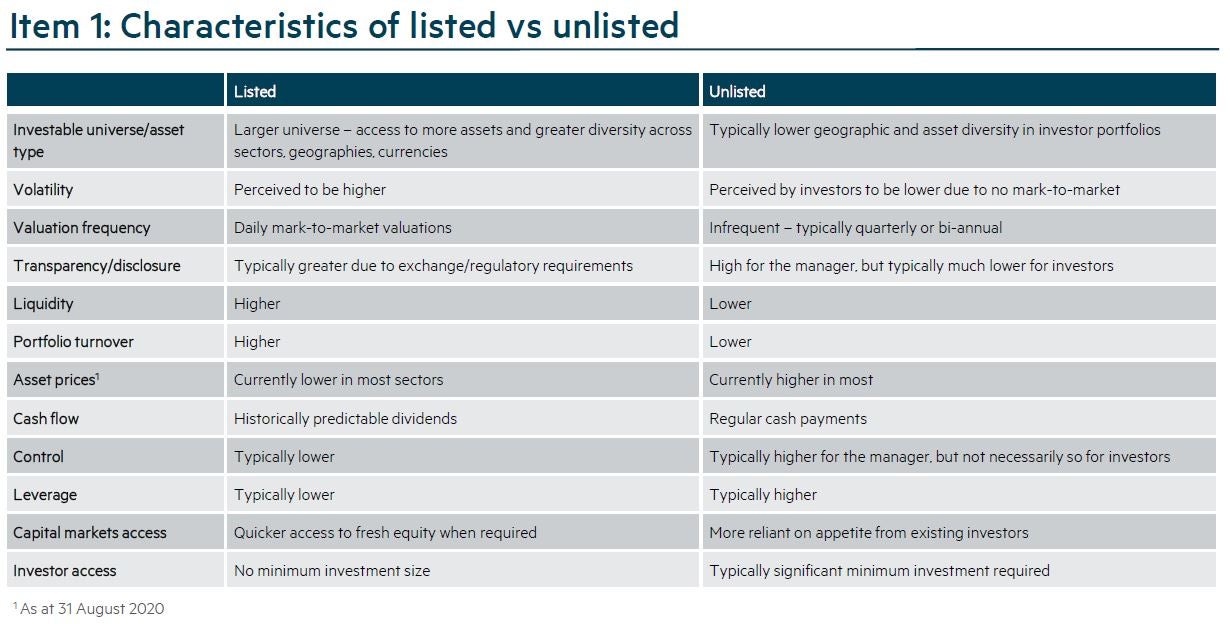

However, these short-term differences start to dissipate when we compare the performance of listed and unlisted infrastructure over longer periods. Despite their different approaches to measuring valuations, we find that both listed and unlisted infrastructure have historically both performed very similarly, with the former exhibiting slightly less volatility over the past 10 years.

Why not both?

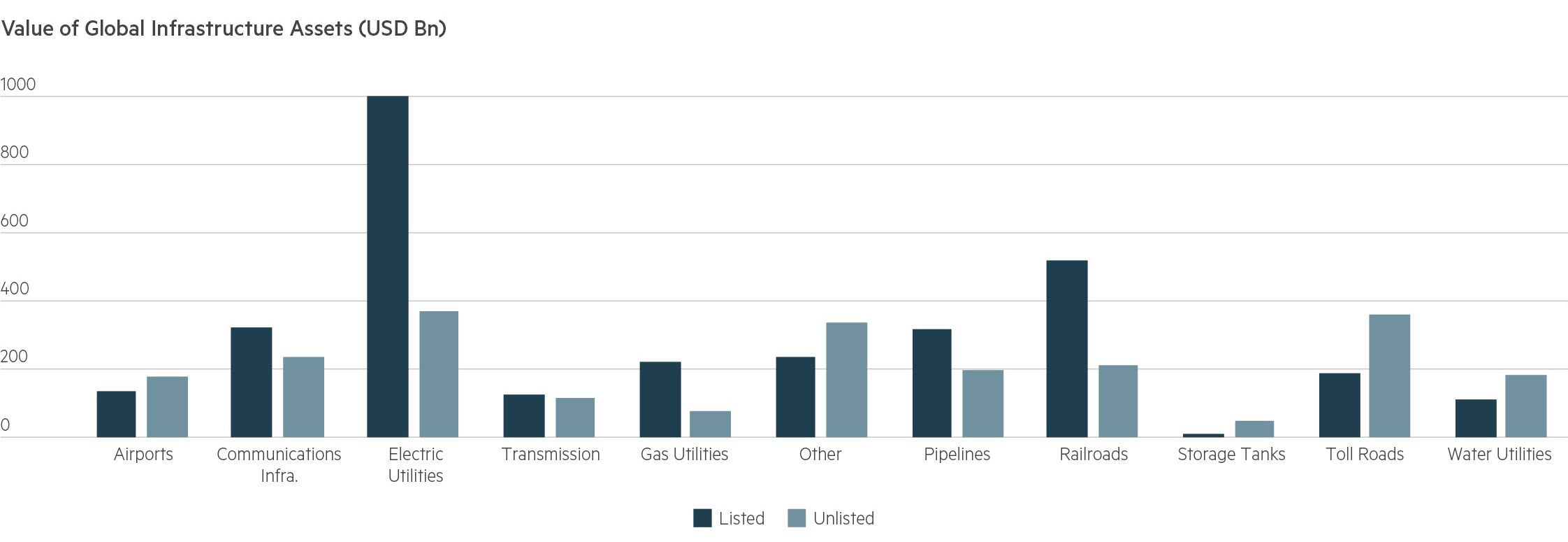

As Item 2 shows, there is a strong case for blending both investment vehicles given they own the same assets and display complementary investment characteristics (see Items 2 and 3). For example, there have been periods where returns for listed and unlisted have been diametrically opposed due to the short-term valuation and volatility disconnect. It is clear that if investors broaden their mandates to include all vehicles targeting “pure” infrastructure, they can benefit from an opportunity set of over $5 trillion in assets.

Item 2: Return comparison between listed and unlisted infrastructure over the last decade*

Mind the premium gap

Private transactions have generally occurred at significant premiums to the multiples of listed infrastructure companies. The substantial levels of fundraising in recent years has given rise to an unwieldy uninvested backlog, otherwise known as “dry powder”, which in 2019 amounted to US$212 billion worth of investor capital.** High levels of private investment demand, coupled with relatively few assets for sale, has heightened competition and driven deal multiples and respective valuations for unlisted infrastructure assets upwards.

We have built up two databases of approximately 100 unlisted transactions in both the airports and water sectors, where publicly available data is the richest. Our findings demonstrate a distortion in the infrastructure investment universe whereby direct investors appear to be willing to pay a significant premium, making the listed market an easier and less expensive way to obtain similar asset exposure.

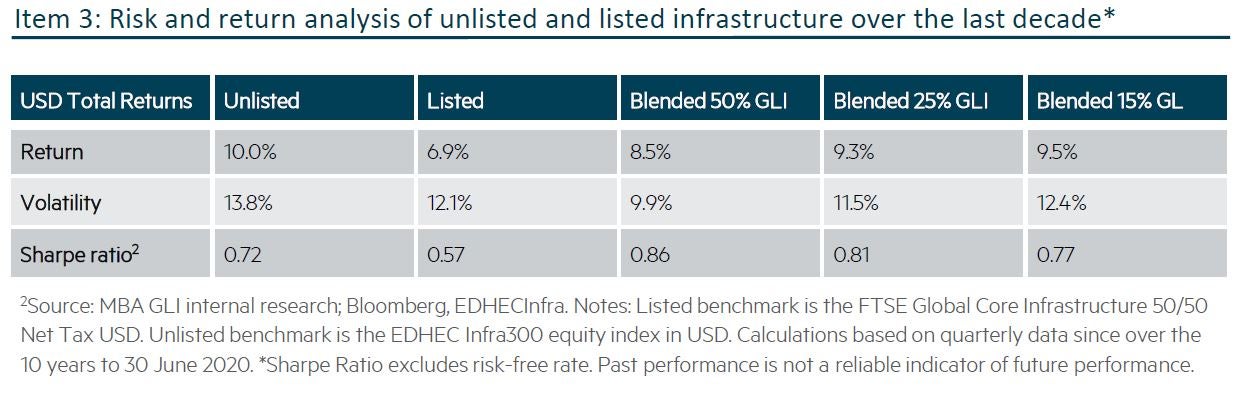

Tapping into a broader universe

We find the infrastructure assets owned by listed and unlisted investors vary between sectors, with some either under-owned or not owned at all by unlisted investors. Although, looking around the world, we find some of the largest airports, distribution and transmission networks, pipeline networks and water utilities are typically owned in listed markets. Evidence suggests there is a finite amount of capital that unlisted investors – whether individually or by consortium – can and will commit to single infrastructure investments, and so ownership of these larger assets becomes more difficult.

Item 4: Comparison of listed and unlisted infrastructure investable universe, by sub-sector^

A final word on the COVID context

While COVID-19 is not a typical economic crisis, it has led to relatively significant deviations between price and value, with significant focus on short-term uncertainty. In times of crises, hindsight often shows how investors in the listed space can deploy capital quickly and buy stocks at attractive prices. We believe this especially true today for a long-duration asset class such as infrastructure that is benefiting incrementally from the significant contraction in interest rates around the world. We encourage investors to consider listed infrastructure as a long-term ‘hold’ investment opportunity versus a short-term mark-to-market risk.

Listed vs unlisted infrastructure – Where do you sit in the debate?