“Events, my dear boy, events”

Former UK Prime Minister Harold MacMillan responding to a question on what the greatest challenge to his administration had been.

The optimism at the beginning of 2023 surrounding China’s emergence from COVID restrictions was almost matched with the pessimism that surrounded the Nasdaq after a tech induced selloff throughout 2022. Yet 12 months later as ‘events’ have transpired, it has been the former that has disappointed and the latter that has dominated returns.

With events wrong-footing many equity market observers throughout the year, investor trepidation heading into 2024 is well and truly warranted. The primary focus, as always, will be on developed markets and reams will be written on the Fed, Trump and geopolitics. In such uncertain times it is worth comparing the increasingly parlous state of the western world with the state of emerging markets. By many measures the new year sees a number of countries and regions across the emerging markets cohort compare relatively well on economic, valuation and even social measures.

EMs: ahead of inflation

Emerging economies have generally been ahead of the curve in fighting inflation, helped by moving early with rate rises and maintaining fiscal discipline during and after the COVID period. That leaves many emerging market governments and central banks in our view well placed to stimulate for growth, should there be any economic slowdown, which many emerging market stocks seem to be pricing in. For example, on an earnings basis, Brazil is trading at 8.0x forward estimates, close to the Dilma crisis lows of 2015/16 when the economy shrunk by more than 3% pa for two consecutive years. Yet Brazilian corporates, like many in Latin America, are broadly reporting positive results, leading to growing earnings in USD terms. At a sector level, energy and financials are similar. For the first time in close to two years, the broad emerging markets index is seeing a sustained lift in the outlook for earnings. At the bottom-up level, it’s possible to find companies that are already reporting strong fundamentals with the market expecting those fundamentals to turn negative. This creates value opportunities for us and it is where we are focusing our attention today. The opposite – weak fundamentals and forecasting a turnaround – is far less appealing in the current fragile global economy.

Tale of the tape

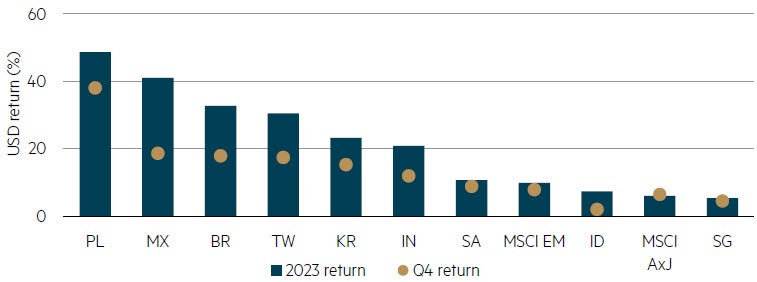

Global emerging markets, as measured by the MSCI Emerging Markets Index, returned +2.0% in AUD terms for the quarter ended 31 December. A strengthening Australian dollar limited index gains, which returned 7.9% in USD terms. This currency move itself is significant. The narrative in the market had been it would be hard for emerging market equities to rally while the US Fed continued to raise rates and attract capital to the US. So a potential peak in yields saw the US dollar weaken and international equities gain. This could be a notable turning point in the interest rate and economic cycle.

Within the emerging markets cohort the Asia ex-Japan region posted its strongest quarter for the calendar year, rising 6.4% in USD terms (0.7% in AUD terms) over the period. The quarter represented many thematics that drove markets for the year. For example, Taiwanese and South Korean technology stocks (related to AI) rallied hard to drive overall country indices higher. India also performed strongly with domestic conditions seeing equity inflows. Meanwhile Chinese equities continued to lag, despite the concerns around its economy easing.

2023 calendar year returns (USD)

Source: FactSet.

China rally still in play?

Chinese equity markets fell for a third consecutive calendar year in 2023, the first time such an event has taken place in near 20 years. After such a long bear market, sentiment towards Chinese equities has moved from ‘dislike’ to ‘revulsion’ over the past 12 months.

As we have noted in previous reports, there is a structural and a cyclical element to China’s slowdown. On the structural side, demographics, debt levels and the size of the economy mean GDP growth will be slower over the coming decade than it has been in the past. From an equity standpoint, this is not necessarily bad news for market returns. Work done by Dimson et al* found that there is little correlation with equity market returns and levels of GDP growth. This is nowhere truer than China’s equity market performance over the last decade, with strong GDP growth reported, while equity investors have seen minimal gains. In our view, what matters more are factors like starting valuations and capital allocation (among a host of other factors) and on these metrics, the news is more positive.

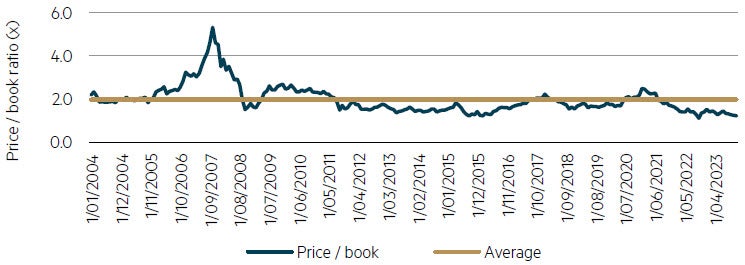

On valuation, after a ~60% fall from its peak, the Chinese equity market is cheap on virtually all measures. A price earnings ratio of less than 9x (on depressed earnings), a dividend yield of ~3.6% and free cashflow yield of ~6% all support this notion. How far are we from bedrock valuations? Using price-to-book as a proxy, current valuations sit within 10% of their 20-year troughs.

MSCI China: within 10% of its 20-year low valuations

Source: FactSet, data to 31 December 2023.

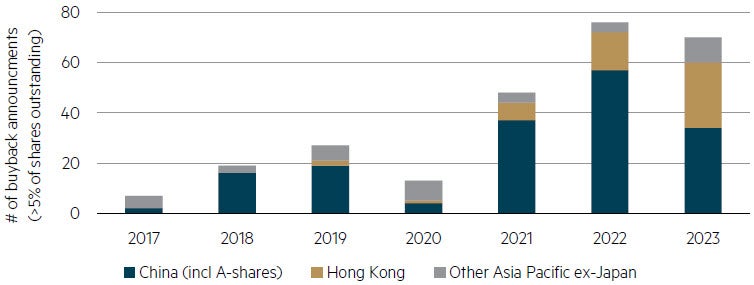

Meanwhile a strong case for improving capital allocation in recent years can be made. Post COVID there has been a significant increase in buyback announcements from Chinese companies. Strong balance sheets, rising free cashflow generation and cheap valuations have been factors in this trend and we expect it to continue into 2024 and beyond.

Major buyback program announcements are on the rise in China

Source: Jefferies, December 2023.

At a portfolio level, we have seen numerous companies including Tencent, Xiaomi, Baidu, Alibaba, VIPshop ZTO and NetEase all conduct buybacks in 2023. At an aggregate level, we acknowledge more can be done (particularly around share cancellations) however the trend is clear: capital allocation in China is improving.

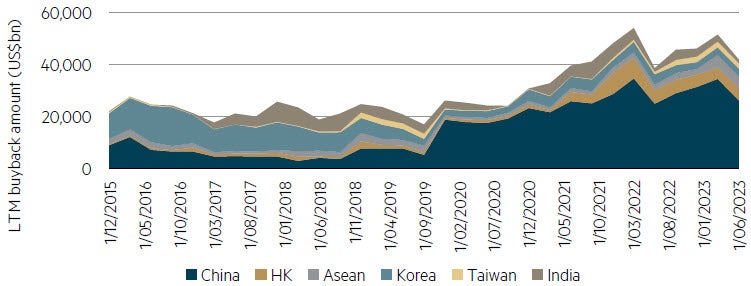

Dollar spending on buybacks is rising across Asia ex-Japan

Source: Jefferies, December 2023.

We remain constructive on Chinese equities, given cheap valuations, low investor positioning and extremely negative sentiment. Under these conditions, it is often the case that events have to simply be ‘less bad’ to witness markets moving higher. Meanwhile government policy remains supportive and growth focused and announcements made over the past six months will continue to find traction in 2024.

Risks of disappointment are rising in AI

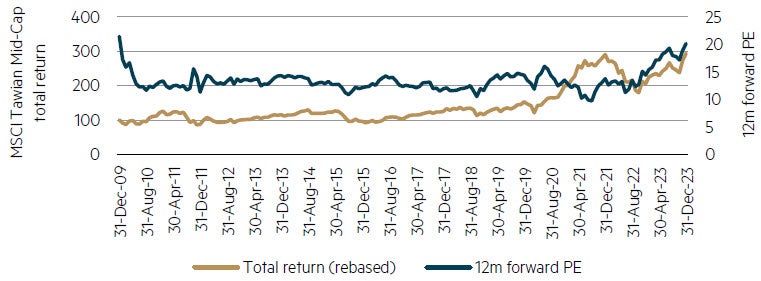

AI has been the major driver of markets globally in 2023. The Asia ex-Japan region was no exception, and this was a major reason why Taiwanese equities delivered strong performance over 2023. The MSCI Taiwan Mid Cap index rose an impressive ~43% in 2023. Looking at the drivers of that return, expanding multiples was the major driver of the return delivered. The 12-month forward price earnings ratio expanded 40% over the year, rising to 20.1x, marking a 14-year high.

While we have little doubt that AI will continue to be a major influence on daily life for many years to come, in terms of equity market returns within Asia, there are some signs that near-term expectations have moved ahead of what can (or will) be delivered.

Mid-Caps in Taiwan – strong performance in 2023* boosted by higher valuations

Source: Bloomberg. * We have used the MSCI Taiwan Mid Cap index, given TSMC accounts for ~40% of the broader MSCI Taiwan index, masking moves (and valuations) in the remaining index.

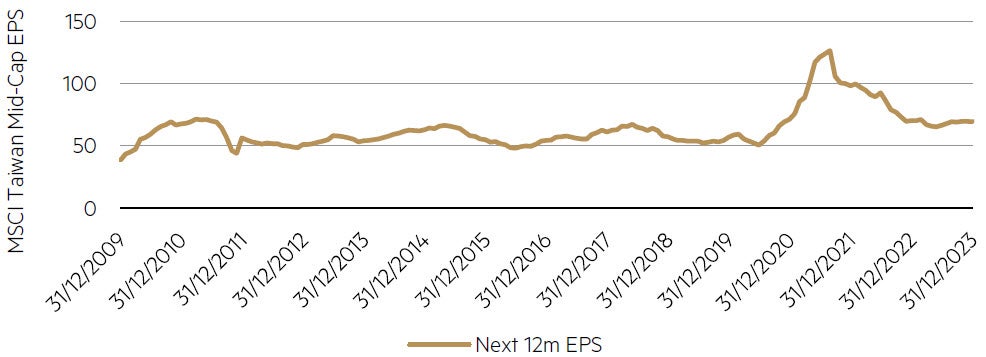

Looking at the forward earnings for this cohort, having come down after the ‘COVID bounce’, they have been essentially flat over the year – starkly contrasting with the excitement and price action related to AI.

MSCI Taiwan Mid-Cap EPS forecasts – unexciting earnings despite AI thematic

Source: Bloomberg.

While we hold positions in Taiwan, it remains an underweight exposure relative to the benchmark and was a headwind to relative performance in 2023. Yet given the combination of high prices led by valuation expansion and lack of improving earnings point to a cautious outlook on Taiwan mid-caps in 2024.

Regulatory fears rise again in Chinese internet

Late in the quarter, the share prices of NetEase and Tencent came under pressure after the National Press and Publication Administration (NPPA) announced a review into the monetisation practices of online game developers. The unexpected move raised fears that this was the start of a new regulatory crackdown on the sector. While the NPPA released further guidance a day later clarifying that this was not the case as well as approving a new batch of games for release, investor confidence (fragile as it is) was hit. Share prices saw a small bounce late in the quarter however much of the damage had been done. Early in the new year the media reported that the person responsible for the policy had been removed from their position, signalling a further backdown and important marker for the industry regarding the tolerance for further regulatory interference.

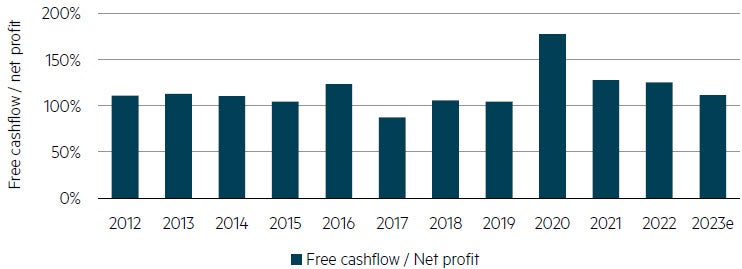

NetEase has been a holding in our broader Asian portfolios for around 10 years. It has successfully navigated the transition from PC gaming to mobile gaming as well as incubated a number of businesses including music streaming, ecommerce and online education. As a game developer, it has long been thought of as a ‘hit or miss’ product type company. Yet, it is a more akin to a holding company, with a portfolio of games that produce significant recurring cashflow from long lasting gaming titles such as Fantasy Westward Journey, New Ghost and Identity V. The nature of these types of businesses (negative working capital requirements and low capital expenditure needs), like many internet related companies means that profits are translated into high levels of free cashflow. Unlike many other internet businesses, rather than using that cashflow to acquire other businesses, NetEase has had a long history of returning profits to shareholder via dividends and share buybacks.

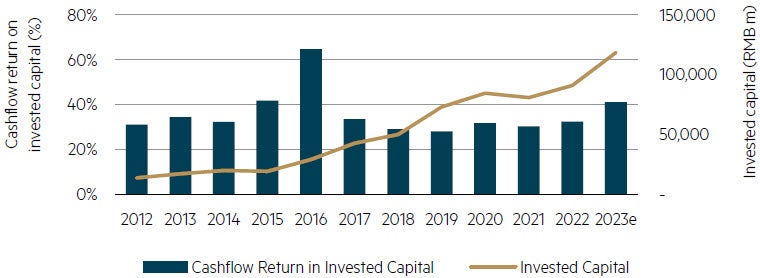

The result has been the company has been able to maintain high levels of cash return on invested capital, at ~30%, as well as grow its invested capital base over time – a powerful combination for wealth creation. Moreover, despite this dynamic, the company’s price earnings ratio over this period has averaged 17.8x forward earnings – an attractive valuation not commensurate with the underlying fundamentals of the business. We note that this valuation metric is higher than the underlying valuation as it excludes cash on balance sheet (now ~20%) as well as expenses all research and development costs up front.

NetEase converts >100% of net profits into free cashflow

Source: Company data, MBA estimates.

NetEase consistently delivers high cashflow returns on invested capital

Source: Company data, MBA estimates.

As to the latest developments, regulatory intervention is not new to the online gaming space, and it remains one of the more heavily regulated industries in China. Approvals for new game releases have been suspended previously in 2018 and 2021/22, as well as major reductions in minor game playing time. Despite this, both NetEase and Tencent have been able to navigate these periods successfully and emerge as stronger companies. Previous bouts of intervention have proven that regulators’ aims are not to shut down or seriously curtail the industry. Online game development has been a genuine home-grown success and increasingly an international growth story for China. Given events subsequent to the initial announcement and our discussions with industry participants and company management teams, we believe this recent intervention will be similar to that of previous ones.

With NetEase now trading at 14x forward earnings, a ~7% free cashflow yield and a growing earnings stream, we continue to hold NetEase in the portfolio and believe its risk/reward skew remains very favourable.

Election uncertainty in 2024

Emerging markets in aggregate face a busy election period over the coming 12 months and indeed, 2024 year will see a record proportion of the global population going to the polls. Taiwan, Indonesia, India, South Korea, India, South Africa and Mexico are all expected to hold elections before the end of the year. Understanding and anticipating change – including within the political sphere – remains a key focus for us as investors.

Taiwanese national elections took place in January, with the pro-independence Democratic Progressive Party (DPP) re-elected. China’s response will be an important marker for the rest of the year. Indonesia has its first round of presidential elections in February while South Korea have legislative elections in April and India hold national elections in May. Among an equally busy second half, the US election in November will be a key investor focus and potential source of uncertainty for markets in 2024.

In our experience in emerging markets, uncertainty arising from campaign policy announcements as well as the election results can create shorter term market volatility. Poland in the fourth quarter of 2023 was a case in point. Often consumption-boosting policies give sentiment and growth a near term boost, however several of the upcoming elections have the potential to have longer lasting impacts for the region and broader international relations. Perhaps more importantly for us, such distortions often create idiosyncratic investing opportunities.

In summary

As bottom-up investors, we are cognisant of these events, but they do not drive our investment process or stock selection. We are looking for companies that will do well under a range of potential scenarios and trying to determine what is priced into prevailing share prices. The 2023 calendar year was one that started with much promise but ultimately disappointed many global emerging market investors. The ‘silver lining’ to the negative sentiment towards much of the region has meant there are many high-quality businesses that generate a growing stream of free cashflow that are trading at deeply discounted valuations. Going into 2024, as contrarian investors, we are optimistic on the outlook for returns given this backdrop as we continue to find investment opportunities.

* Elroy Dimson, Paul Marsh and Mike Staunton, Triumph of the Optimists: 101 Years of Global Investment Returns, 2002, Princeton University Press, Princeton.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 31 January 2024 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2024 Maple-Brown Abbott Limited.